May 28, 2021 | Budget Deficit, Family Enterprise USA, In The News

Thank you to Brandon Roman and the team at Squire Patton Boggs (US) LLP for this report. The Biden Administration this afternoon released its FY22 Budget Request. The proposal, which is estimated to cost more than $6 trillion, would dramatically expand the size and...

May 27, 2021 | Family Businesses, Family Enterprise USA, In The News, Taxes

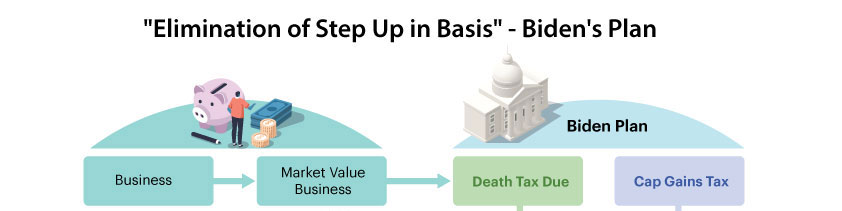

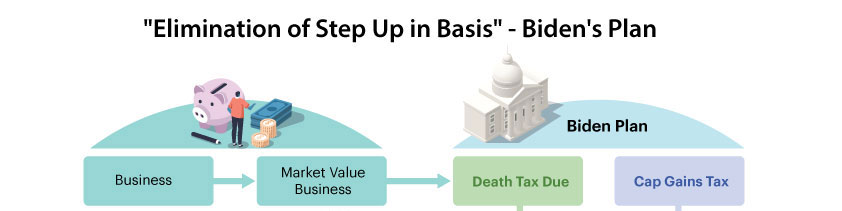

While the devil is in the details, it is possible that if President Biden’s elimination of step-up in basis proposal is passed by Congress you could be paying an estate tax at 40%, and a capital gains tax at 43.4%. The graphic below shows an example of a...

May 26, 2021 | Estate Taxes, Family Enterprise USA, In The News

The estate tax (also known as the death tax) is one of three taxes on assets and businesses passed from one person to another, whether through wills, trusts, or gifts. The other two are the gift tax and the generation-skipping transfer tax. They all have similar rules...

May 20, 2021 | Family Enterprise USA, In The News

John Gugliada Joins Family Enterprise USA As Director Strategic Partnerships And Business Development John Marino Joins Policy And Taxation Group As Director Of Strategic Partnerships And Business Development “Our Board of Directors, a team of experienced...

May 18, 2021 | Estate Taxes, Family Businesses, Family Enterprise USA, In The News, Income Taxes, Taxes

On Wednesday, May 12, the House Ways & Means Select Revenue Measures Subcommittee held a hearing titled “Funding Our Nation’s Priorities: Reforming the Tax Code’s Advantageous Treatment of the Wealthy.” The following witnesses testified at...

May 13, 2021 | Estate Taxes, Family Businesses, Family Enterprise USA, In The News, Income Taxes, Taxes

Earlier today, Congressman Jodey Arrington (R-TX) and Congressman Henry Cuellar (D-TX) and Senator Tom Cotton (R-AR), on a bipartisan, bicameral basis, introduced the Estate Tax Rate Reduction Act of 2021. This legislation would reduce the estate, gift and generation...

May 11, 2021 | Estate Taxes, Family Businesses, Family Enterprise USA, In The News, Income Taxes, Taxes

Register Now Pat Soldano will be apeaking on “Family Business Economic Impact, Family Business Issues and Voter Attitudes”. Family Businesses employ 59% of all workers in the US and generate 54% of GDP, (“2021 Contribution of Family Businesses to the US...

May 11, 2021 | Family Businesses, Family Enterprise USA, In The News

By Torsten M. Pieper, Franz W. Kellermanns, Joseph H. Astrachan & Nina Anique Hadeler The Importance of Family Businesses’ Contribution to the U.S. Economy A survey provides some updated figures Everyone involved with family businesses knows that those businesses...

May 9, 2021 | Family Business Survey, Family Businesses, Family Enterprise USA, In The News

2021 FEUSA Family Business Survey Highlights Estate Tax As The #1 Economic Public Policy Priority Issue For Family Businesses Washington DC, May 9, 2021: Family Enterprise USA, releases results of FEUSA 2021 Family Business Survey revealing that while Income Tax is...

May 4, 2021 | Family Businesses, Family Enterprise USA, In The News

We hope you will join us for a FEUSA update call on May 6, 2021 at 12pm PT or 3pm ET. Below is the Zoom Webinar agenda for the noteworthy speakers who will be talking on current legislative and political agendas and platforms: Welcome by Pat Soldano and intro Frank...