Jun 23, 2020 | COVID-19, Family Business Stories, Family Businesses, Family Enterprise USA

Our company was founded by my grandpa in 1953 as Seneca Sawmill. We are now owned by my mother and my two aunts. We have grown over the years and we now have 168,000 acres of timberlands that we manage sustainably (we have 92% more timber on that land than we had 25...

Jun 16, 2020 | COVID-19, Family Business Stories, Family Business Survey, Family Businesses, Family Enterprise USA, Presentation

Family Enterprise USA’s 2020 survey sheds light on factors that family business owners see as obstacles to growth. Legislators must know what is important to family business owners — what helps or hurts them when it comes to operating their businesses and creating...

Jun 12, 2020 | Family Business Survey, Family Businesses, Family Enterprise USA, Presentation

Plan to Attend: A Conversation with FEUSA’s President/CEO Pat Soldano and the Drucker School’s Director of the Family Business Institute Kathleen Fariss June 25, 2020 2 p.m. ET | 11 a.m. PT 45 minutes The COVID-19 crisis represents many immediate and...

Jun 9, 2020 | COVID-19, Family Businesses, Family Enterprise USA, Presentation

Plan to Attend: COVID-19 required many family firms to change the way they do business, from checking employees’ temperatures before each shift to serving an entirely new market. What success factors enabled them to adapt, and will the changes be permanent? Friday,...

Jun 2, 2020 | Family Business Survey, Family Businesses, Family Enterprise USA, Watch & Listen

Family business owners want lower taxes, less regulation Family Enterprise USA’s 2020 survey shed light on factors that family business owners see as obstacles to growth. By Patricia M. Soldano, President Family Enterprise USA Legislators must know what is important...

Jun 2, 2020 | COVID-19, Family Enterprise USA, In The News

For the first time since early 2020, the dominant topic in the American policy debate is not the COVID-19 pandemic. With national attention consumed by protests, riots and the state of race relations in the United States, efforts continue in Washington to stabilize...

Jun 1, 2020 | Family Business Survey, Family Businesses, Family Enterprise USA, In The News

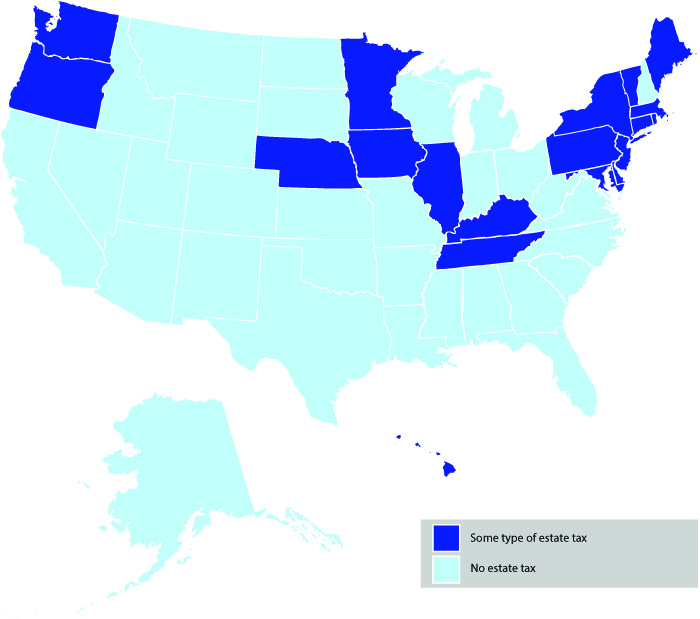

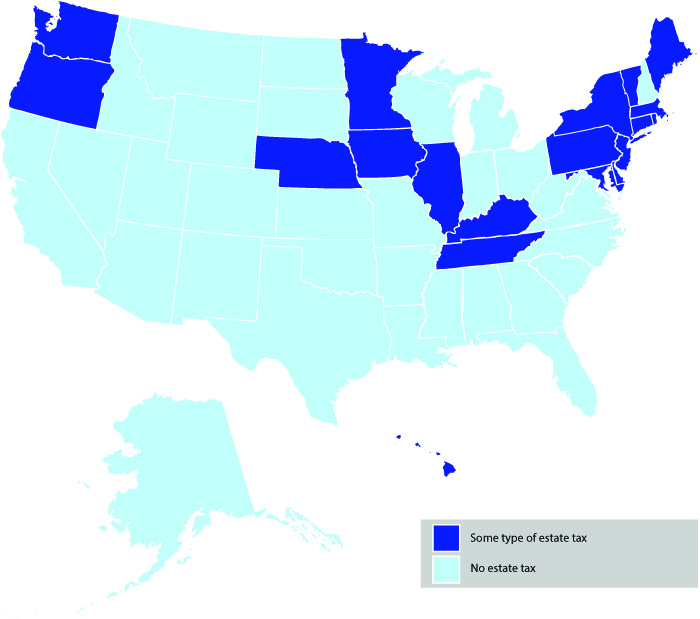

The 2020 FEUSA Survey was conducted between January 31st and April 24th during the global Coronavirus pandemic. As of mid-March much of the United States was under some form of stay-at-home order and survey responses reflect concerns as a result of this unexpected...

May 28, 2020 | Family Enterprise USA, In The News

Hawaii Taxes could rise on high-end real estate on the island of Hawaii Illinois The top Republicans in the Illinois legislature are pushing for a vote that would remove from the November ballot a measure that would allow for a progressive income tax. Democrat...

May 26, 2020 | COVID-19, Family Enterprise USA, In The News

The Senate has left for their Memorial Day district work period. When the upper chamber returns on June 1, it’s likely to focus on clearing pending presidential nominations as House Democrats and Senate Republicans remain far apart on the next round of COVID-19...

May 24, 2020 | COVID-19, Family Enterprise USA, In The News

While the world is slowly starting to open up and move toward “normal,” it seems as if DC has already gotten there – politically at least. After passing four stimulus bills on a pretty bi-partisan basis – and racking up almost $3 trillion in spending – political...

May 22, 2020 | COVID-19, Family Enterprise USA, In The News, Taxes

What to Expect in Next Economic Recovery Package House Democrats’ Opening Bid—The HEROES Act Only four days after its May 12 introduction, the House narrowly approved the HEROES Act (H.R.6800), 208-199. The legislation contains Democratic policy priorities, including...