Constant, Consistent Education with Congress Pays Off in ‘One Big Beautiful Bill’ for Family-owned Businesses, Family...

Constant, Consistent Education with Congress Pays Off in ‘One Big Beautiful Bill’ for Family-owned Businesses, Family...

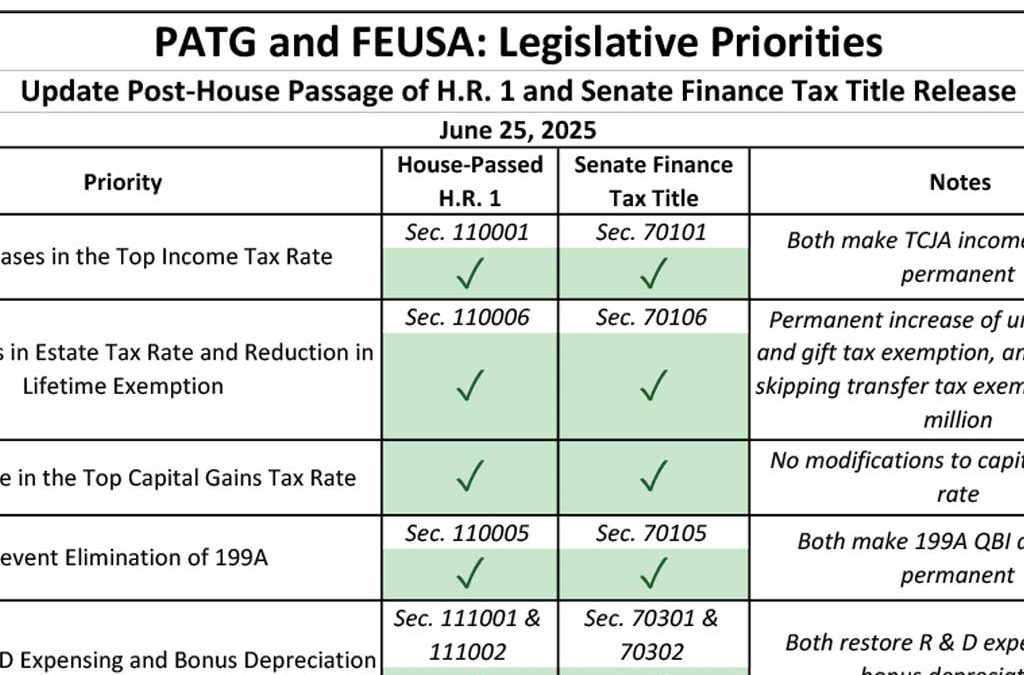

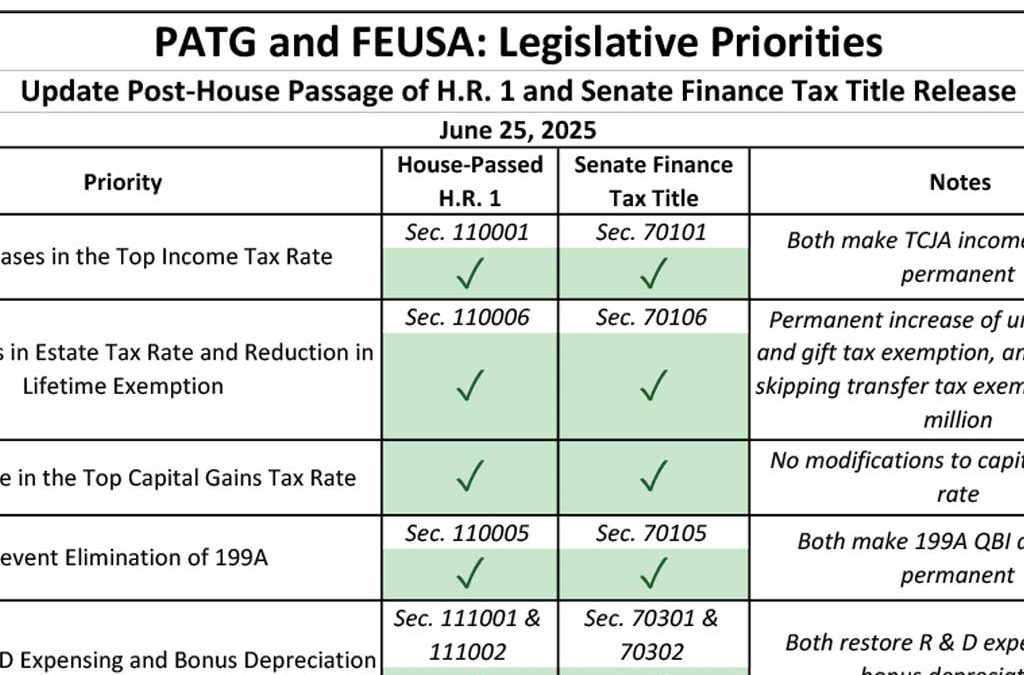

On July 3, the House adopted the Senate substitute to H.R. 1, the One, Big, Beautiful Bill Act (OBBBA) by a vote of...

Join Pat Soldano, Russ Sullivan, and John Gugliada at the 2025 FOX Family Office & Wealth Advisor Forum, where...

We Need Your Help! Do It Now! Contact Your Representatives in Congress. We Need Them to Join the Congressional...

New White Paper Says New IRS Funding Expected to Increase Focus on Partnerships, Corporations, and High Net-Worth...

We Need Your Help! Do It Now! Contact Your Representatives in Congress. We Need Them to Join the Congressional...

We Need Your Help! Do It Now! Contact Your Representatives in Congress. We Need Them to Join the Congressional...

We Need Your Help! Do It Now! Contact Your Representatives in Congress. We Need Them to Join the Congressional...

House Tax-Writing Committee Advances GOP Economic Bills. The House Ways and Means Committee approved a trio of...

We Need Your Help! Do It Now! Contact Your Representatives in Congress. We Need Them to Join the Congressional...

We Need Your Help! Do It Now! Contact Your Representatives in Congress. We Need Them to Join the Congressional...

GOP Lawmakers Prepare Expansive Tax-Reform Proposal. House Republicans are expected to unveil an economic-growth...

by Thomas C. Berg, JR., CFA, ASA, CVA & David M. Eckstein, CFA IRS Releases Inflation Reduction Act Strategic...

On Saturday, May 27, House Speaker Kevin McCarthy (R-CA) and President Joe Biden reached an agreement to suspend the...

Negotiators Highlight Progress on Debt-Ceiling Deal Despite Lack of Public Agreement on Legislative Framework....

We Need Your Help! Do It Now! Contact Your Representatives in Congress. We Need Them to Join the Congressional...

We hope you've enjoyed this article. While you're here, we have a small favor to ask... As we prepare for what...

Senate Democrats Scrutinize Tax Practices of Pharmaceutical Companies, While Republicans Take Aim at Pillar Two. On...

We hope you've enjoyed this article. While you're here, we have a small favor to ask... As we prepare for what...

We Need Your Help! Do It Now! The Caucus meeting is 5/16. Contact Your Representatives in Congress. We Need...

We Need Your Help! Do It Now! The Caucus meeting is 5/16. Contact Your Representatives in Congress. We Need...

Debt-Limit Increase Discussions Commence After Negotiators Mark Their Turf. President Joe Biden met with congressional...

We Need Your Help! Do It Now! The Caucus meeting is 5/16. Contact Your Representatives in Congress. We Need...

We hope you've enjoyed this article. While you're here, we have a small favor to ask... As we prepare for what...

Published by Trusts & Estates Things are about to change for America’s largest private employer, the family...

We hope you've enjoyed this article. While you're here, we have a small favor to ask... As we prepare for what...

Laird Coatings Founder Ed Laird Details Transition to New Family Leadership After 50 Years, in New Video by Family...

We hope you've enjoyed this article. While you're here, we have a small favor to ask... As we prepare for what...

On Wednesday, April 26, the House of Representatives voted to pass the GOP proposal to avert the impending government...

House GOP Offers Repeal of Green-Energy Tax Credits and Expanded IRS Funding in Initial Debt-Ceiling Proposal. On...

May 10 New York Presentation Showcases Expert Discussion on Tax Policies Facing Congress, Impacts on Family Businesses...

Treasury and IRS Under the Spotlight at Upcoming Congressional Tax Hearings. On Wednesday, the House Committee on Ways...

Family businesses continue to anchor America’s economy. Every year we conduct research on America’s largest...

High Personal Tax Levels Top Concerns of America’s Largest Private Employer, Family Businesses, New Study Finds New...

General Updates Programming Update: This newsletter will be taking a hiatus during the congressional recess. We...

Tax Tidbit Biden to Release 2024 Budget Proposal Later this Week. On March 9, President Joe Biden will send his...

Tax Tidbit Werfel Faces IRS Funding Questions on Route to Likely Senate Confirmation. On Wednesday, Feb. 15, the...

In 2023, all 50 state legislatures will convene, including biennial legislatures. Nationwide, state legislatures will...

New Family Business Videos Reveal Difficulties, Successes in Transitioning to Next Generation, Giving Back to...

Yesterday, Senate Democrats proposed legislation to fund the federal government through Dec. 16 with the use of a...

Democrats Prepare Another for Expanded CTC. With the year-long effort to legislate a comprehensive energy, healthcare...

The United States has one of the highest rates of estate tax in the world. While other countries may call a tax on...

The U.S. Congress was in session this week. Democrats in the U.S. Senate fell short in their effort to approve voting...