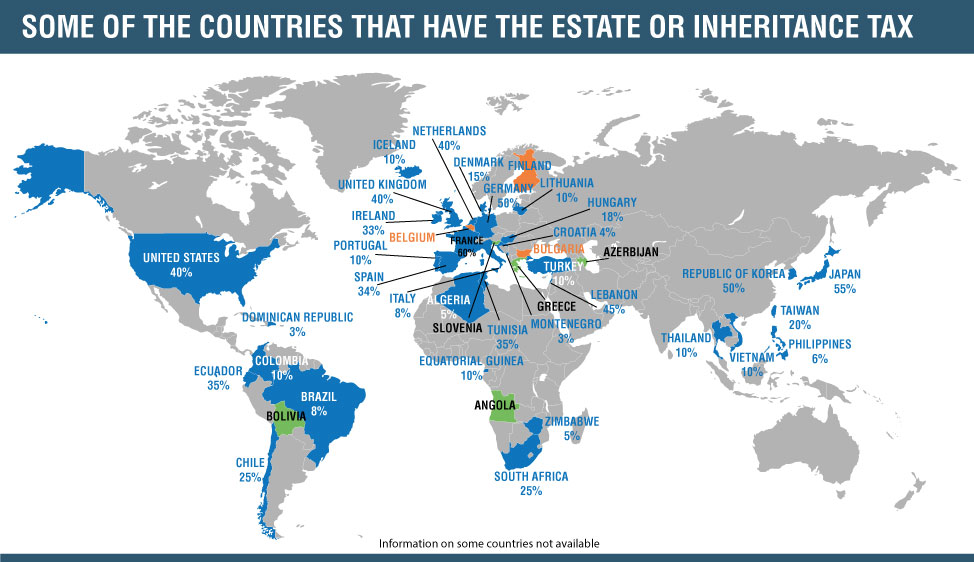

The United States has one of the highest rates of estate tax in the world. While other countries may call a tax on assets at death, an estate or inheritance tax it is still an additional tax on assets.

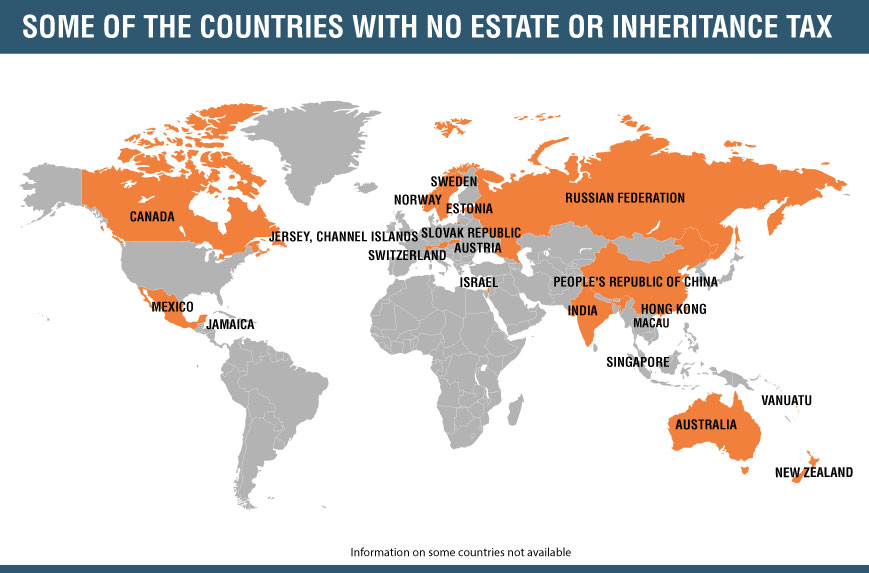

Many other developed countries have eliminated their estate or inheritance tax like Russia, India, China, Australia, Norway, Mexico, and more.

The United States continues to impose an estate tax on assets at death for over 100 years. This tax imposes additional costs to family businesses making competing with countries who do not impose an estate or inheritance tax very difficult. For those countries including the US who currently have an estate or inheritance see the image below.

Family Enterprise USA advocates for American Family business. We help family businesses communicate their challenges and contributions to American economic freedom to Legislators. We represent all American family businesses; not just specific industries and provide research to enhance the opportunity for success. We help family businesses continue to establish their unique business legacy. Family Enterprise USA is a 501(c)(3) non-profit organization.. Family foundations can donate.

@FamilyEnterpriseUSA @PolicyAndTaxationGroup @DitchTheEstateTax #FamilyBusiness #Business #SmallBiz #EstateTax #Deathtax #CapitalGainsTax #StepUpInBasis #Taxes #gifttax #Generationskippingtax #InheritanceTax #repealestatetax #promotefamilybusinesses #taxLegislation #AdvocatingForFamilyBusinesses #incometax #Generationallyowned #Multigenerationalbusiness