Sep 1, 2018 | Estate Taxes

Before leaving for last week’s Fourth of July Recess, Ways and Means Committee Member Rep. Kenny Marchant (R-TX) introduced H.R. 6228, which would permanently increase the estate and gift tax exemption from $5 million to $10 million. As we have previously reported,...

Aug 23, 2018 | Estate Taxes

Chairman Brady intends to have the House address the 2018 Tax Bill 2.0 when they return from August recess; note that it will include making the estate tax life exemption doubling permanent. Click here for a brief recap of the legislation. Many meetings last week in...

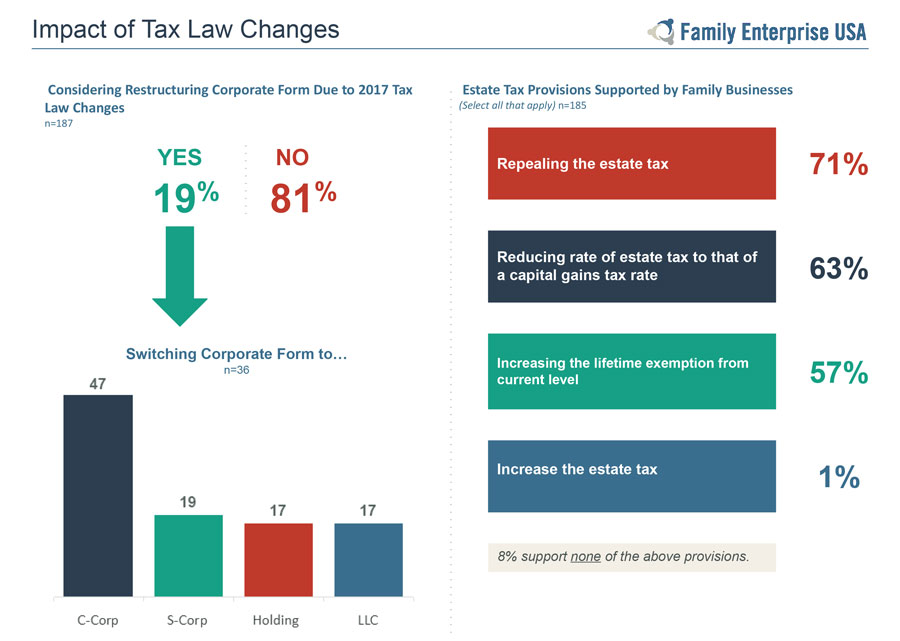

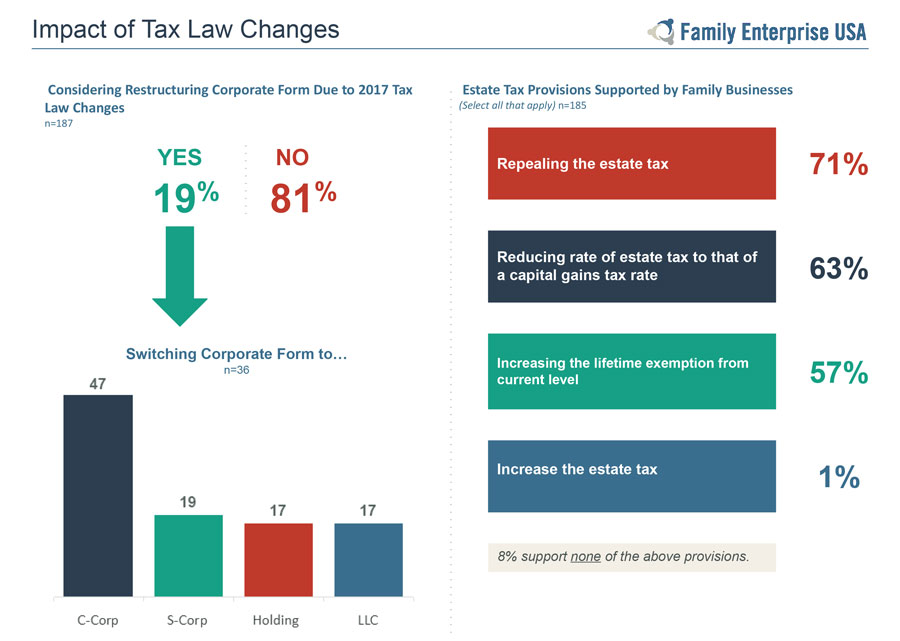

Jul 24, 2018 | Family Enterprise USA, Family Business Survey, Family Businesses

View and Download The 2018 FEUSA Family Business Survey View and Download The 2018 FEUSA Family Business Survey

Jul 23, 2018 | Estate Taxes

Congressman Devin Nunes (CA-22) has introduced a bill in the House of Representatives to eliminate capital gains taxes on inflation. By ending this unfair tax, the Capital Gains Inflation Relief Act (H.R 6444) will encourage both individual and business investment...

Jul 5, 2018 | Estate Taxes

My personal view, for what is might be worth, is that lowering the corporate tax rate from the current 35% to 20% is too big a cut and unnecessary to serve the purpose intended. Certainly, a cut is needed, but just as certainly a reduction to 25% would provide the...