Oct 3, 2017 | Estate Taxes

In 2005, Elizabeth Marshall Maybee inherited a 3000-acre Northern California ranch from her grandmother that had been in the family since the 1880s. However, “the Marshall Ranch, which survived the Great Depression and survived a case of eminent domain for the...

Oct 3, 2017 | Estate Taxes

Tom Crowder’s grandfather had a passion for the outdoors and sustainability. This was reflected in the 6,000 acres of pines, bottomland hardwoods, and wildlife occupying his forest in south central Arkansas. However, counter-intuitively, his grandfather took such good...

Oct 3, 2017 | Estate Taxes

Earlier today, the White House, House Ways and Means Committee, and Senate Finance Committee released their highly-anticipated “unified framework” for tax reform, which calls for elimination of the death tax and its principal components. While the framework is lacking...

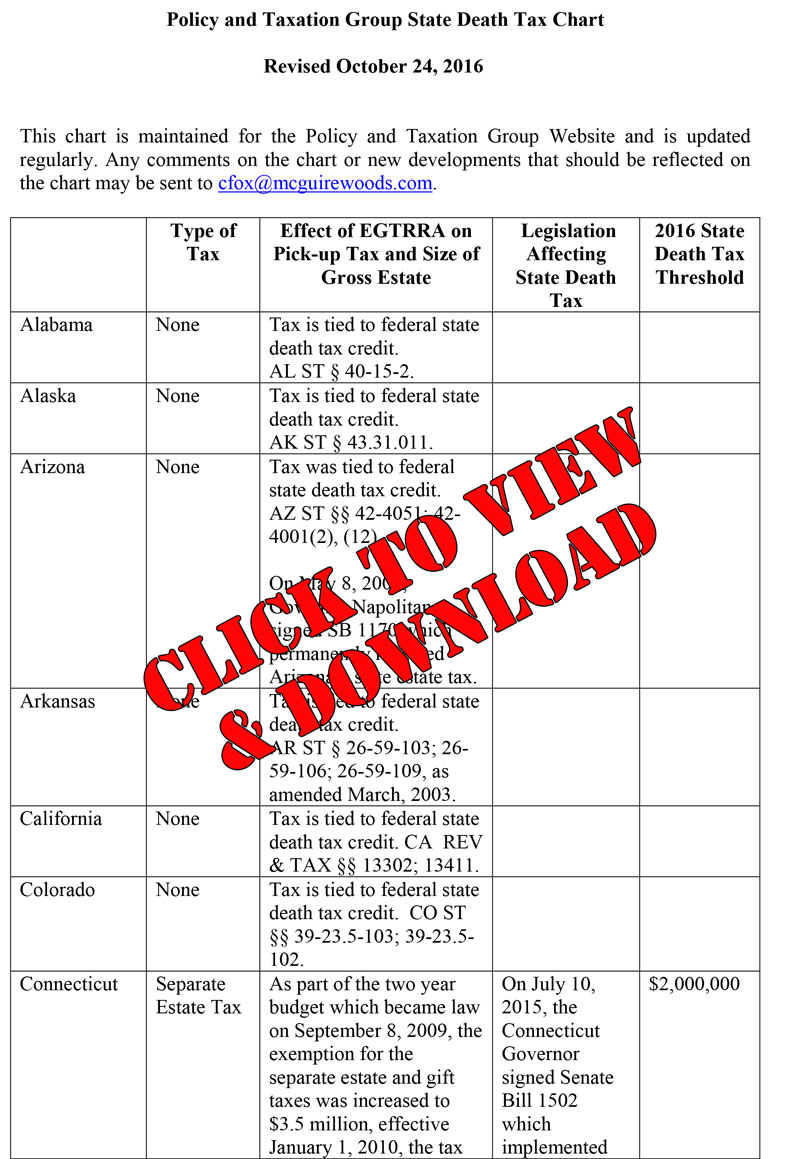

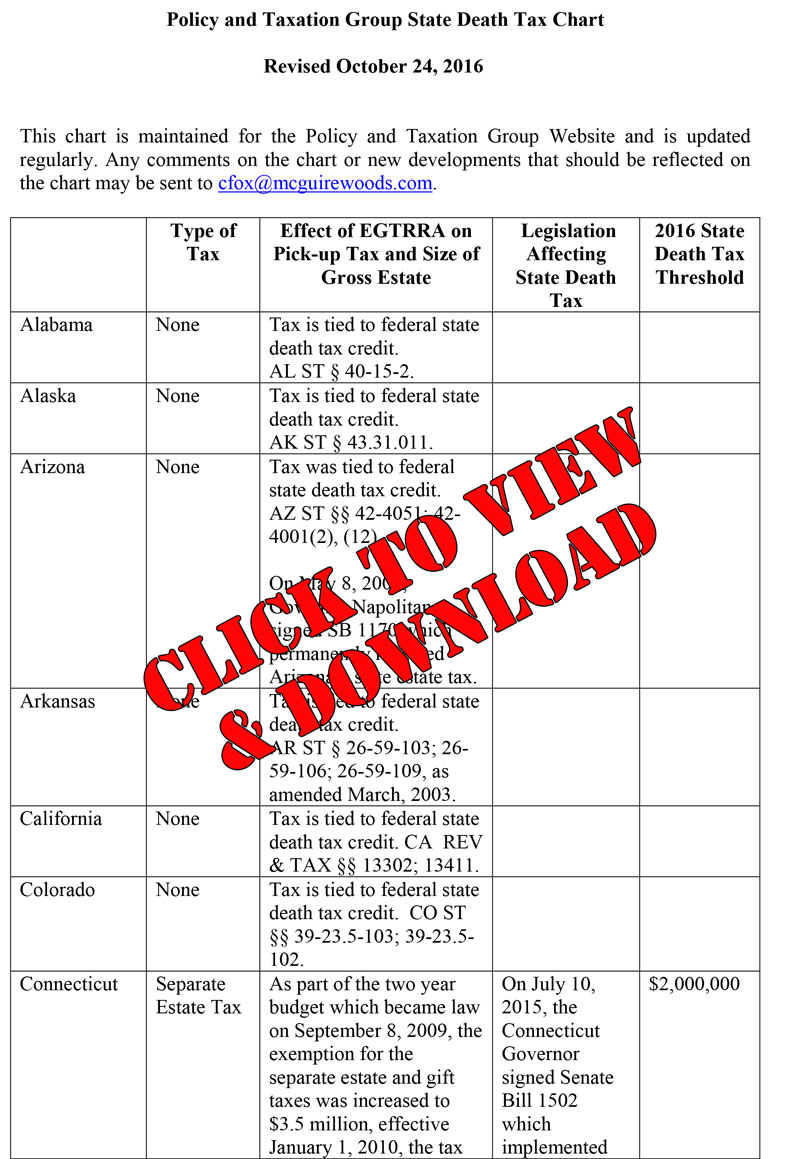

Oct 25, 2016 | State Death Tax, Estate Taxes

Policy and Taxation Group State Death Tax Chart This chart is maintained for the Policy and Taxation Group Website and is updated regularly.

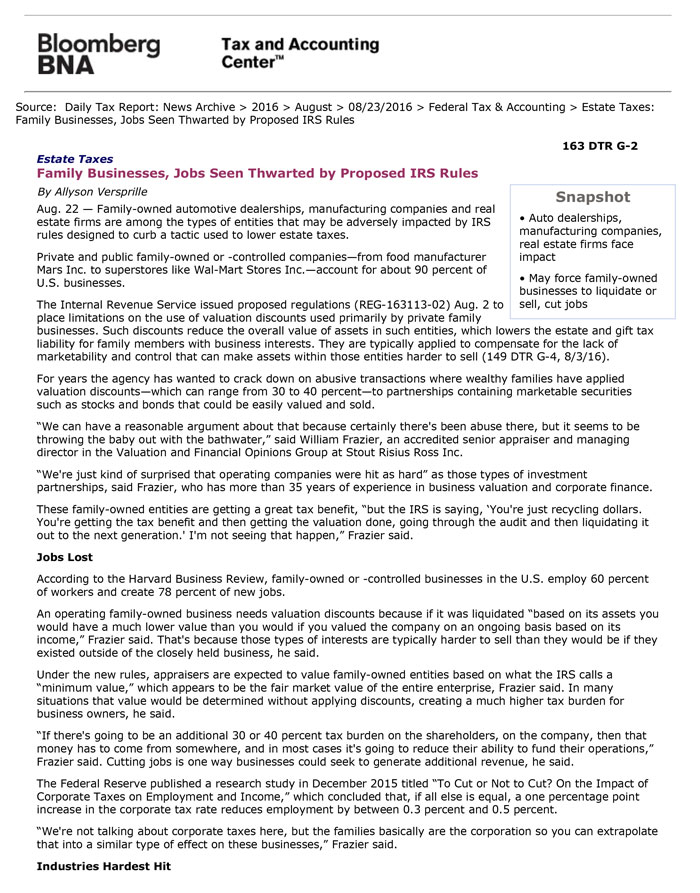

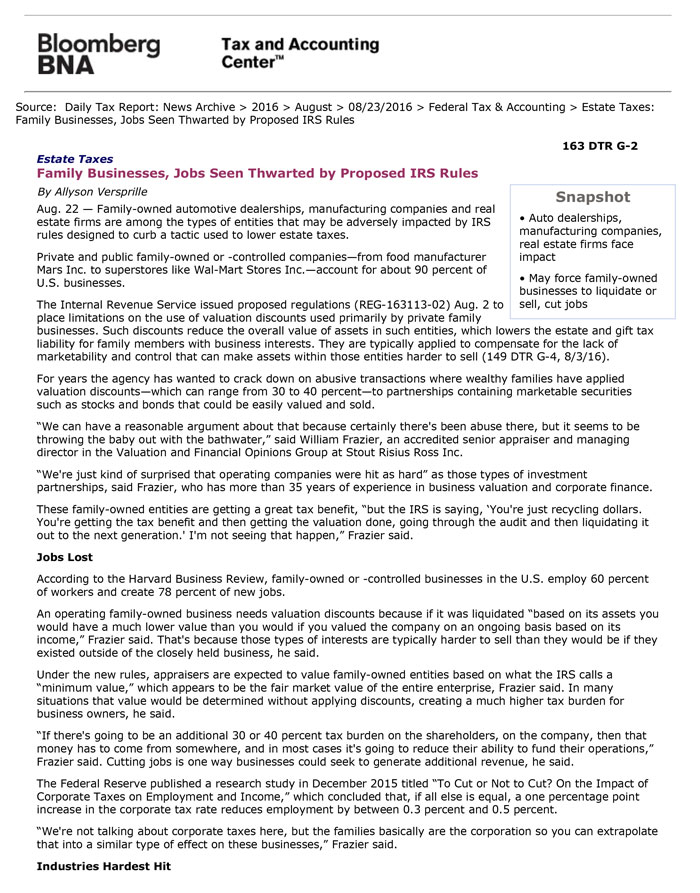

Aug 25, 2016 | Family Enterprise USA, Estate Taxes

Read the full Family Businesses, Jobs Seen Thwarted by Proposed IRS Rules story.

Dec 31, 2015 | Family Enterprise USA

In order to understand what is most troubling to family firms, survey respondents were asked to rank the importance of various public policy issues. The issue that got the strongest response was “reducing the deficit and debt.” Successful family firms embrace a sense...