Jan 29, 2025 | Family Businesses, Estate Taxes, Family Owned Business, Income Taxes, Taxes

Your Perspective Matters: Complete Our Family Business Survey Take 5 minutes to share your insights and gain access to our exclusive 2025 webcast. Sen. Daines, Rep. Smucker Introduce Bill to Extend and Make Permanent the Section 199A Deduction: On Jan. 23, Sen. Steve...

Jan 28, 2025 | Family Businesses, Estate Taxes, Family Owned Business, Income Taxes, Taxes

Your Perspective Matters: Complete Our Family Business Survey Take 5 minutes to share your insights and gain access to our exclusive 2025 webcast. Rep. Jodey Arrington Introduces House Bill to Amend IRS Code to Reduce Rate of Tax on Estates, Gifts, and...

Jan 27, 2025 | Family Businesses, Estate Taxes, Family Owned Business, Income Taxes, Taxes

Your Perspective Matters: Complete Our Family Business Survey Take 5 minutes to share your insights and gain access to our exclusive 2025 webcast. On January 22, 2025, the House Ways and Means Committee hosted a Member Day Hearing featuring testimony from 55 Members...

Jan 22, 2025 | Family Businesses, Estate Taxes, Family Owned Business, Income Taxes, Taxes

Your Perspective Matters: Complete Our Family Business Survey Take 5 minutes to share your insights and gain access to our exclusive 2025 webcast. Budget Committee Document Detailing Potential Tax Bill Provisions Circulated: A leaked list of policy options purported...

Jan 16, 2025 | Family Businesses, Estate Taxes, Family Owned Business, Income Taxes, Taxes

Your Perspective Matters: Complete Our Family Business Survey Take 5 minutes to share your insights and gain access to our exclusive 2025 webcast. Navigating the Final Biden Treasury/IRS Guidance Over the last week, the Treasury Department and Internal Revenue Service...

Jan 3, 2025 | Family Businesses, Estate Taxes, Family Owned Business, Income Taxes, Taxes

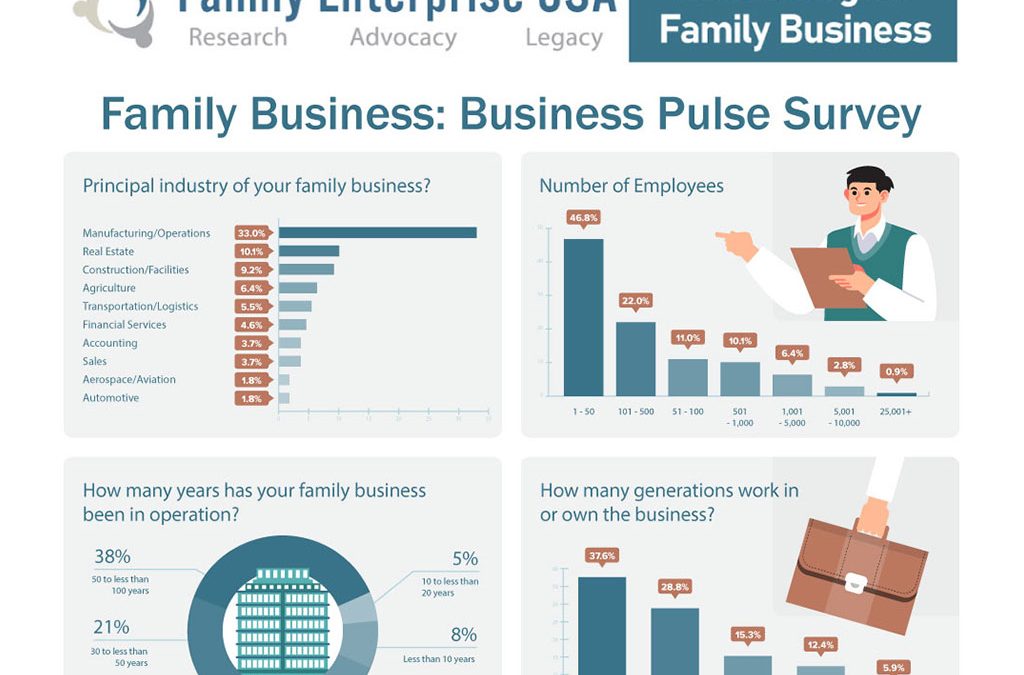

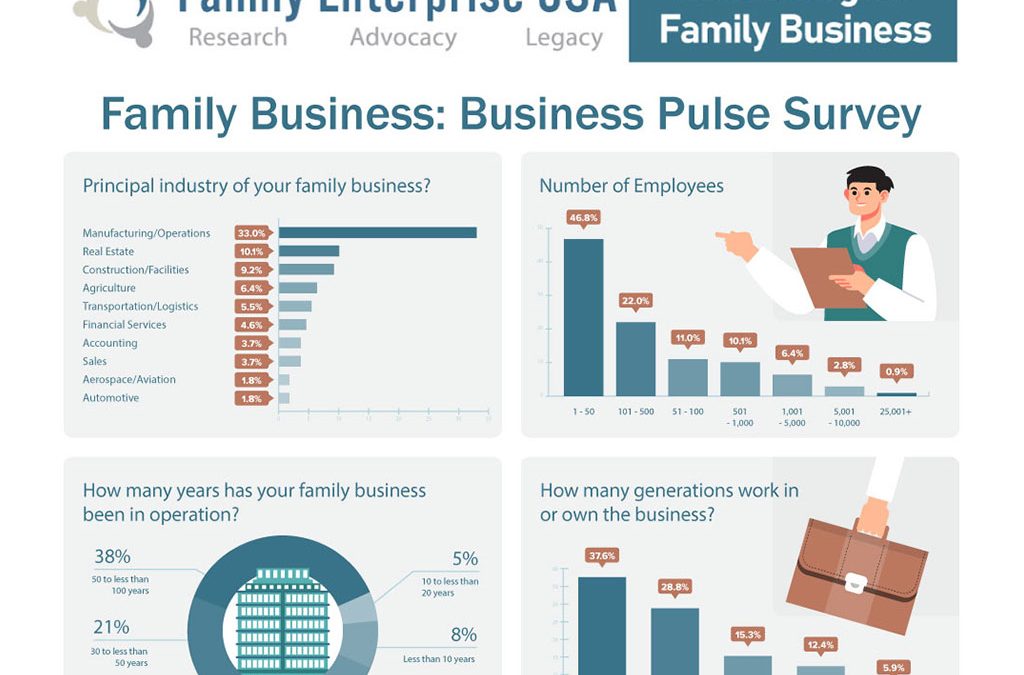

Your Perspective Matters: Complete Our Family Business Survey Take 5 minutes to share your insights and gain access to our exclusive 2025 webcast. New Family Enterprise USA Pulse Survey Shows Top 3 Tax Policies Family Businesses are Concerned about Going in 2025...

Dec 19, 2024 | Family Businesses, Estate Taxes, Family Owned Business, Income Taxes, Taxes

Your Perspective Matters: Complete Our Family Business Survey Take 5 minutes to share your insights and gain access to our exclusive 2025 webcast. Reconciliation State of Play – Debate Continues Over Bill Strategy: As the start of the 119th Congress looms, House...

Dec 13, 2024 | Family Businesses, Estate Taxes, Family Owned Business, Income Taxes, Pat Soldano, Taxes

An increase in income tax rate means you'll pay a higher percentage of your income to the government. This directly reduces your disposable income, the money you have left after taxes for spending or saving. This can make it harder to afford basic necessities, save...

Dec 12, 2024 | Family Businesses, Estate Taxes, Family Owned Business, Income Taxes, Taxes

An increase in income tax rate means you'll pay a higher percentage of your income to the government. This directly reduces your disposable income, the money you have left after taxes for spending or saving. This can make it harder to afford basic necessities, save...

Nov 26, 2024 | Family Businesses, Family Owned Business, Pat Soldano, Podcast, Video Post, Watch & Listen, Webcast Replays

An increase in income tax rate means you'll pay a higher percentage of your income to the government. This directly reduces your disposable income, the money you have left after taxes for spending or saving. This can make it harder to afford basic necessities, save...

Nov 19, 2024 | Family Businesses, Estate Taxes, Family Owned Business, Income Taxes, Taxes

An increase in income tax rate means you'll pay a higher percentage of your income to the government. This directly reduces your disposable income, the money you have left after taxes for spending or saving. This can make it harder to afford basic necessities, save...