Oct 21, 2025 | Family Businesses, Family Owned Business, Income Taxes, Taxes

Family Businesses Concerned About Potential New Wealth Tax Act Re-Introduced in Congress Bill by Sen. Wyden Gets House Support, Targets Unrealized Gains Family businesses and tax experts are taking a hard look at the new wealth tax bills recently...

Oct 20, 2025 | Family Businesses, Family Owned Business

Save your spot for this exclusive webcast: Register Now November 5, 2025 | 10:00 AM – 11:00 AM PDT “Parenting Amidst Wealth: Navigating the Shift as Kids Enter Adulthood” For many families behind highly successful family-owned businesses, early...

Oct 17, 2025 | Family Businesses, Family Owned Business

You do all you can to keep your family members safe and secure their futures. That means engaging with experts for guidance with wealth management, philanthropy, taxes, trusts and estate planning. Insurance is a significant part of managing the exposures your...

![[WEBCAST] Help the Next Generation Thrive: Parenting Amidst Wealth](https://familyenterpriseusa.com/wp-content/uploads/2025/10/Instagram-pathstone-webcast-1-1024x675.jpg)

Oct 16, 2025 | Family Businesses, Family Owned Business

Save your spot for this exclusive webcast: Register Now November 5, 2025 | 10:00 AM – 11:00 AM PDT “Parenting Amidst Wealth: Navigating the Shift as Kids Enter Adulthood” For many families behind highly successful family-owned businesses, early...

Oct 15, 2025 | Family Businesses, Family Enterprise USA, Family Owned Business, Pat Soldano

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. By Patricia M. Soldano President Family Enterprise USA Where There’s Smoke…New Wealth, Estate Tax...

Oct 15, 2025 | Family Businesses, Estate Taxes, Family Owned Business, Income Taxes, Taxes

Bisignano, Koopman Join IRS Leadership: The Internal Revenue Service (IRS) has announced significant leadership changes amid ongoing agency restructurings. Secretary Bessent will remain as acting IRS commissioner, although Sen. Chuck Grassley (R-IA) said that he had...

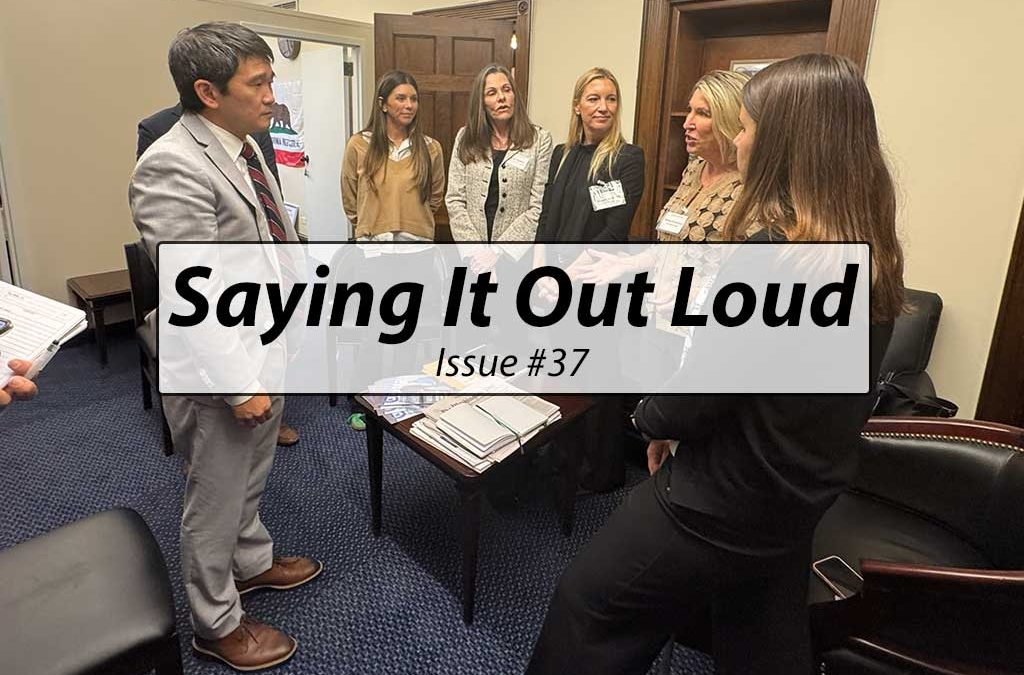

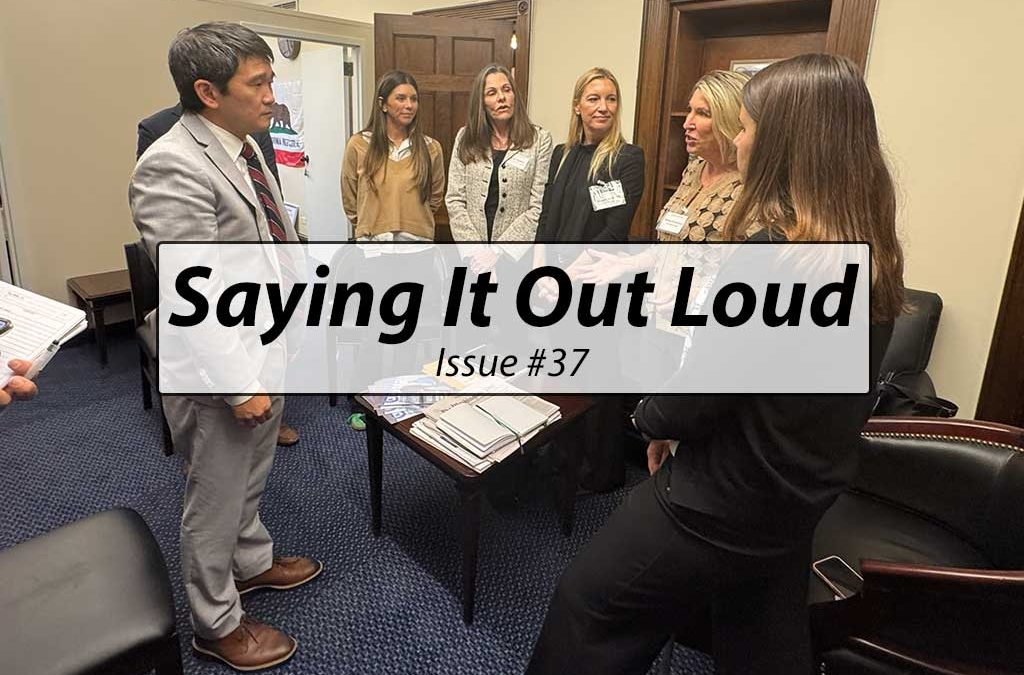

Oct 14, 2025 | Family Businesses, Family Business Caucus, Family Enterprise USA, Family Owned Business, Video Post, Watch & Listen

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. Family Business Leaders Discuss ‘Legacy & Longevity’ on Capitol Hill During Meeting with...

Oct 10, 2025 | Family Businesses, Family Owned Business

Save your spot for this exclusive webcast: Register Now October 15, 2025 | 10:00 AM – 11:00 AM PDT “Pass-throughs vs. Corporations: Tax Trade-offs for Family Enterprises” For family enterprises, few decisions are more consequential than choosing...

Oct 9, 2025 | Family Businesses, Family Enterprise USA, Family Owned Business

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. By Ashley FontanettaSenior Vice President and Client AdvisorWhittier Trust “When I speak with a client...

![[WEBCAST] Help the Next Generation Thrive: Parenting Amidst Wealth](https://familyenterpriseusa.com/wp-content/uploads/2025/10/Instagram-pathstone-webcast-1-1024x675.jpg)