Apr 23, 2025 | Family Businesses, Family Enterprise USA, Family Owned Business

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. Family Enterprise USA Reaches Million Member Milestone with Outreach to Associations with Family-Owned...

Apr 18, 2025 | Family Businesses, Family Owned Business

Complex family and business dynamics can derail the generational transition of a family enterprise. Addressing this risk demands clear boundaries between family, ownership, governance and management. Parallel governance, or the establishment of separate...

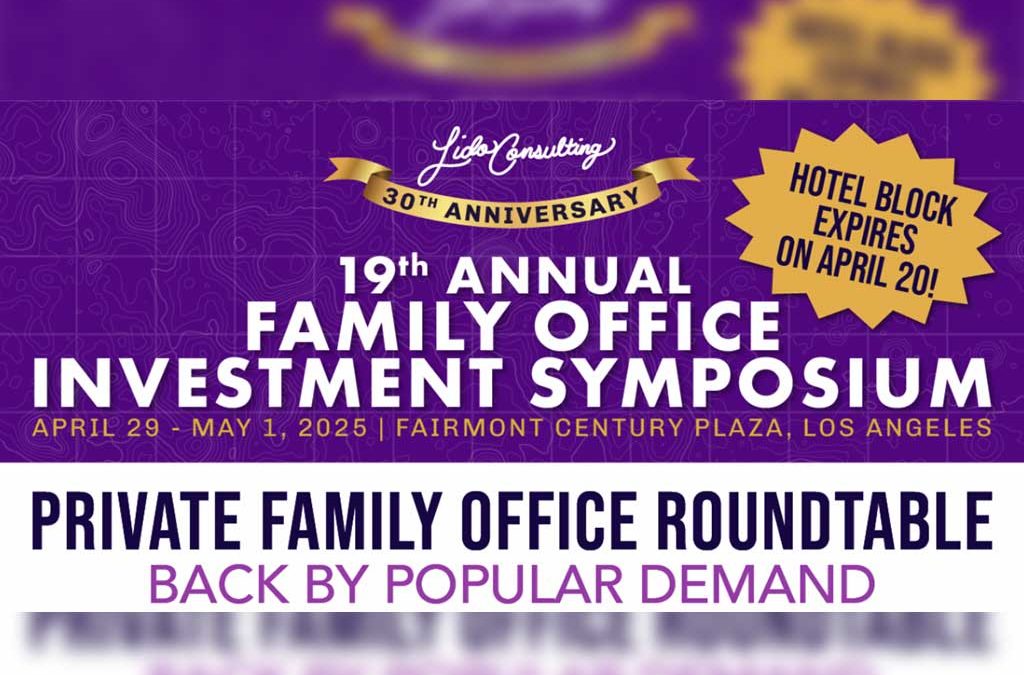

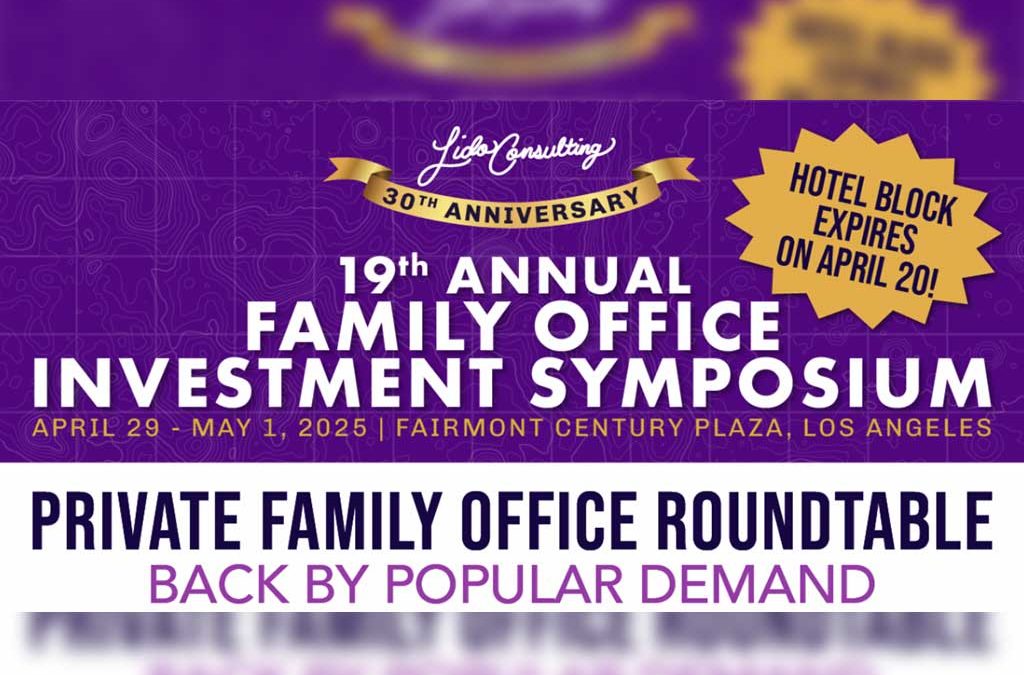

Apr 17, 2025 | Family Businesses, Family Enterprise USA, Family Owned Business

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. Lido Consulting’s 19th Annual Family Office Investment Symposium Features Family Enterprise USA...

Apr 15, 2025 | Family Businesses, Family Enterprise USA, Family Owned Business

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. Family Enterprise USA’s Pat Soldano, Brownstein’s Mark Warren Speak at Sonoma Authors Festival on...

Apr 15, 2025 | Family Businesses, Family Owned Business

Complex family and business dynamics can derail the generational transition of a family enterprise. Addressing this risk demands clear boundaries between family, ownership, governance and management. Parallel governance, or the establishment of separate...

Apr 11, 2025 | Family Businesses, Family Enterprise USA, Family Owned Business, Video Post, Watch & Listen

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. IFA’s recent webinar, Protecting the Legacy of Family Businesses & Successful Individuals in...

Apr 10, 2025 | Family Businesses, Family Enterprise USA, Family Owned Business

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. ISYS SOLUTIONS INC. Wins Excellence in Social Impact Award; Hydraflow’s Cindy Ayloush Receives...

Apr 10, 2025 | Family Businesses, Family Enterprise USA, Family Owned Business, Taxes, Video Post, Watch & Listen

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. Family Enterprise USA (FEUSA) President Pat Soldano led an exclusive discussion on the latest tax and...

Apr 10, 2025 | Family Businesses, Family Owned Business, Taxes

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. Senate Completes Vote-a-Rama to Advance Budget Resolution: On April 4 and 5, the Senate considered the...

Apr 8, 2025 | Family Businesses, Family Owned Business

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. ‘Ethical Fading,’ Women Investing Events Held at CSUF’s Center for Family Business Feature Family...