May 30, 2025 | Family Businesses, Estate Taxes, Family Owned Business, Income Taxes, Taxes

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. DOJ Issues New Guidance on White-Collar Prosecutions and Corporate MonitorsBy Greg Brower, Evan...

May 29, 2025 | Family Businesses, Family Enterprise USA, Family Owned Business

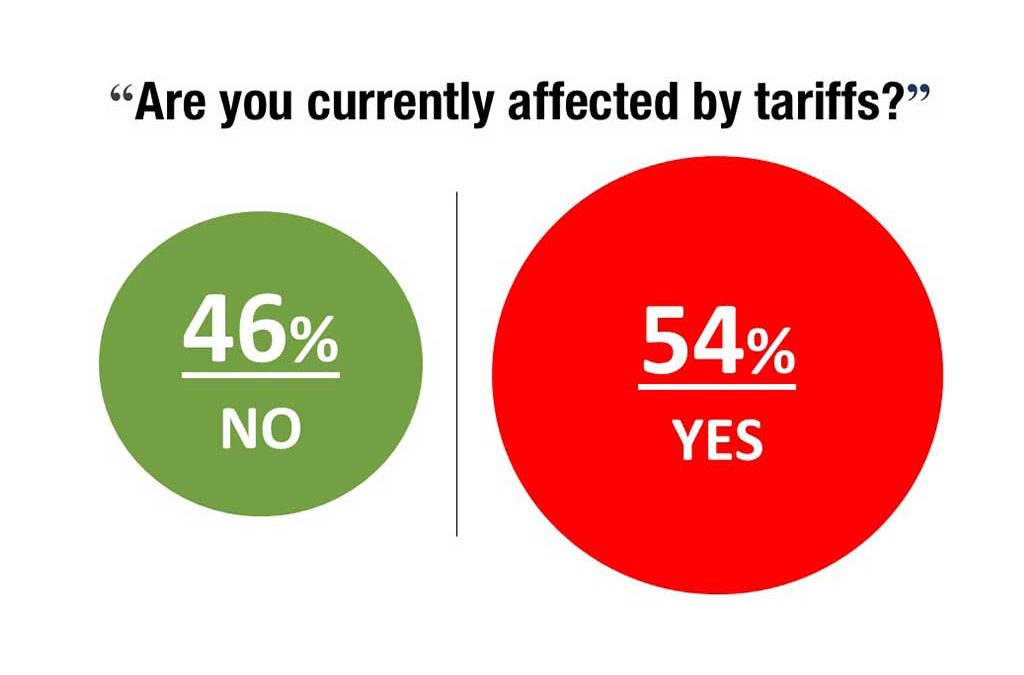

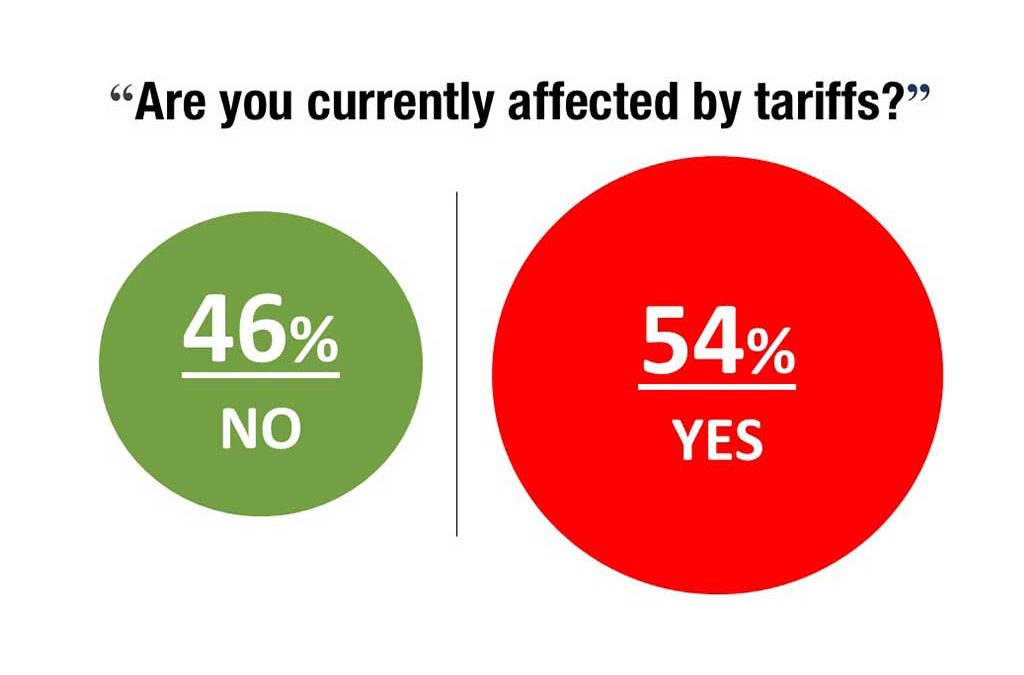

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. Family Enterprise USA recently conducted a “Spot Poll” among family-owned businesses leaders on the...

May 28, 2025 | Family Businesses, Family Enterprise USA, Family Owned Business, Income Taxes, Taxes

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. On May 22, the House of Representatives passed H.R. 1, “The One, Big, Beautiful Bill Act,” legislation...

May 28, 2025 | Family Businesses, Family Business Caucus, Family Enterprise USA, Family Owned Business, Video Post, Watch & Listen

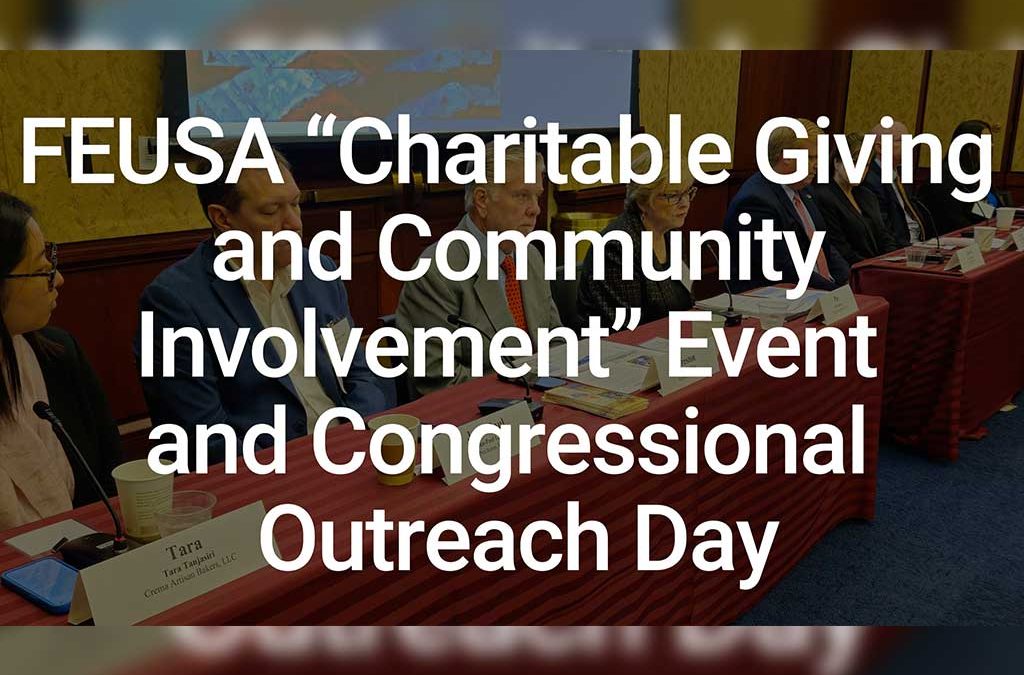

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. Pat Soldano opened the event by thanking Members of Congress, congressional staff, and family-owned...

May 27, 2025 | Family Businesses, Family Enterprise USA, Family Owned Business, Podcast, Video Post, Watch & Listen, Webcast Replays

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. Family Office Hiring Trends Detailed in New Mack Intl. Webcast; New Family Business Magazine Podcast...

May 23, 2025 | Family Businesses, Family Enterprise USA, Family Owned Business, Pat Soldano

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. By Patricia M. Soldano President Family Enterprise USA New Coalition of Women Business Owners Empowers...

May 22, 2025 | Family Businesses, Family Owned Business

Register Now May 30, 2025 | 10:00 AM – 11:00 AM PDT “Estate Planning for High-Net-Worth Families: Beyond the Basics” When it comes to estate planning for high-net-worth and ultra-high-net-worth families, the basics are just the beginning. Join us...

May 22, 2025 | Family Businesses, Family Enterprise USA, Family Owned Business, Income Taxes, Taxes

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. On May 22, just before 7 am ET, the House of Representatives passed Republicans’ multi-trillion-dollar...

May 20, 2025 | Family Businesses, Family Enterprise USA, Family Owned Business, Podcast, Video Post, Watch & Listen, Webcast Replays

The data is in! See what family owned businesses are saying about today’s challenges and opportunities. Read the 2025 Annual Survey Executive Survey now! Click here. Building the Right Family Office, Using Parallel Governance Strategies Detailed by EY’s Family...

May 17, 2025 | Family Businesses, Family Owned Business

Register Now May 30, 2025 | 10:00 AM – 11:00 AM PDT “Estate Planning for High-Net-Worth Families: Beyond the Basics” When it comes to estate planning for high-net-worth and ultra-high-net-worth families, the basics are just the beginning. Join us...