Oct 28, 2020 | Family Businesses, Family Enterprise USA, Taxes, Video Post, Watch & Listen

If you are not an FEUSA Member, JOIN now! Election 2020 – Presidential Candidates’ Positions on Estate and Wealth Tax Policies If you are not an FEUSA Member, JOIN now! Family Enterprise USA is the organization that represents all family businesses...

Oct 26, 2020 | Family Businesses, Family Enterprise USA, Taxes, Video Post, Watch & Listen

If you are not an FEUSA Member, JOIN now! Election 2020 – Safety and Healthy Workplace Tax Credit If you are not an FEUSA Member, JOIN now! Family Enterprise USA is the organization that represents all family businesses on a national level in DC; it is...

Oct 23, 2020 | Family Businesses, Family Enterprise USA, Taxes, Video Post, Watch & Listen

If you are not an FEUSA Member, JOIN now! The Corporate Transparency Act will create significant privacy concerns for families, family businesses, and family offices. Specifically, this bill: Requires corporations and limited liability companies to disclose their...

Oct 21, 2020 | Family Businesses, Family Enterprise USA, Taxes, Video Post, Watch & Listen

If you are not an FEUSA Member, JOIN now! Pass Through and Small Business Legislation Under President Trump or former Vice President Biden If you are not an FEUSA Member, JOIN now! Family Enterprise USA is the organization that represents all family...

Oct 15, 2020 | Family Businesses, Family Enterprise USA, Taxes, Video Post, Watch & Listen

If you are not an FEUSA Member, JOIN now! Pass Through and Small Business Legislation Under President Trump or former Vice President Biden If you are not an FEUSA Member, JOIN now! Family Enterprise USA is the organization that represents all family businesses...

Oct 10, 2020 | COVID-19, Family Businesses, Family Enterprise USA, Taxes

Pat Soldano welcomed supporters to the call and provided an overview of the topics to be discussed: the status of the November Election, potential tax policy opportunities, and additional COVID-19 relief legislation as well as an update on the activities of Policy and...

Sep 8, 2020 | Family Businesses, Family Enterprise USA, Taxes

The Corporate Transparency Act will create significant privacy concerns for families, family business and family offices. Specifically, this bill: Requires corporations and limited liability companies disclose their true, beneficial owners to FinCEN at the time the...

Sep 7, 2020 | Family Businesses, Family Enterprise USA, In The News, Taxes

During an Internal Revenue Service monthly payroll teleconference today, Kelly Morrison-Lee, an agency attorney, confirmed that the payroll tax deferral is optional at the discretion of the employer. This confirms that employers, not employees, have the choice of...

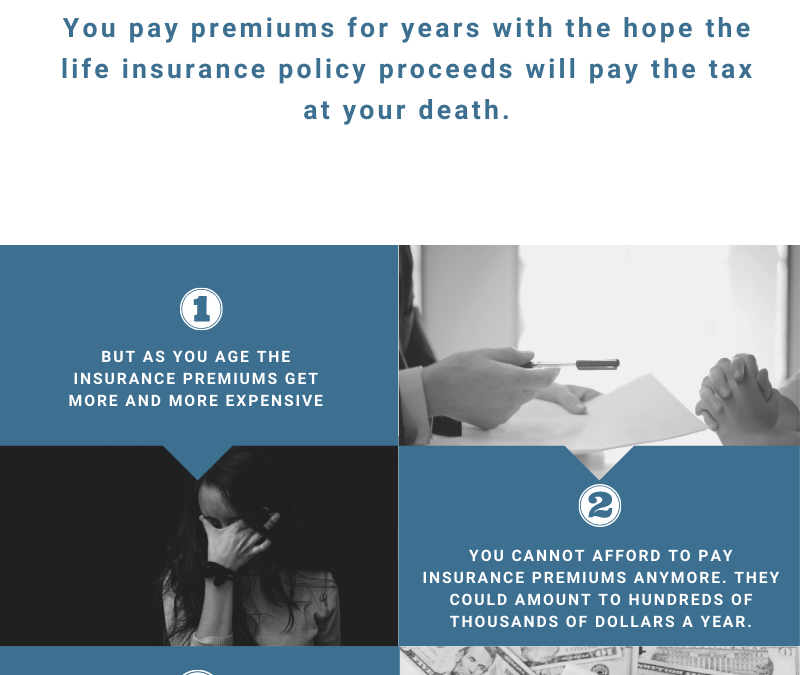

Aug 26, 2020 | Estate Taxes, Family Businesses, State Death Tax

If you are not an FEUSA Member, JOIN now! Family Enterprise USA is the organization that represents all family businesses on a national level in DC; it is not unique to any industry. FEUSA is different from other organizations because it represents and...

Aug 24, 2020 | COVID-19, Family Business Stories, Family Businesses, Family Enterprise USA

As General Motors and other companies push to make ventilators to help COVID-19 patients streaming into U.S. hospitals, the Lee Company of Westbrook, Conn., has adjusted its systems to join the effort. The family company, founded in 1948, makes miniature hydraulic...