Sep 3, 2021 | Family Businesses, Family Enterprise USA, In The News

Have Your Voice Heard in Congress. Please Take Action Today!!! We asked the question “Do Legislators Listen to You?”. See the results of this National poll via the infographic below. Contact Congress Now - It Only Takes a Minute Family Enterprise USA...

Aug 30, 2021 | Family Businesses, Family Enterprise USA, In The News

Have Your Voice Heard in Congress. Please Take Action Today!!! by By Mark J. Richards, The Madison Group, Inc It has always been important for a business to adapt and manage change. The culture of many successful family enterprises has evolved to use their closely...

Aug 26, 2021 | Estate Taxes, Family Businesses, Family Enterprise USA, In The News, Taxes, Video Post, Watch & Listen

Have Your Voice Heard in Congress. Please Take Action Today!!! While life insurance is important and useful for many purposes, does it provide a resource to pay the estate tax for most families? Hear one family’s story in which the family member “aged out” of the...

Aug 25, 2021 | Family Businesses, Family Enterprise USA, In The News

Family Business owners plan their business as a legacy to their family, their employees, and the community. To sustain and grow that legacy, estate planning is critical. Please join us for this upcoming webinar with BNY Mellon Wealth Management to learn some of those...

Aug 25, 2021 | Estate Taxes, Family Business Stories, Family Businesses, Family Enterprise USA, In The News, Income Taxes, Step-Up In Basis, Taxes, Video Post, Watch & Listen

Contact Congress Now - It Only Takes a Minute Casey Roscoe with Seneca Jones Timber Company Talks about Managing Today’s Resources for Tomorrow Casey Roscoe is a 3rd generation family member of Seneca, a women owned timber business, in Eugene Oregon. Listen to her...

Aug 24, 2021 | Family Businesses, Family Enterprise USA, In The News

Participate in our latest poll question and see what others are saying: How long is your longest-term employee?(Required) 1 to 4 years 5 to 9 years 10 to 14 years 15 to 19 years 20 or more years Submit Have Your Voice Heard in Congress. Please Take Action Today!!!...

Aug 20, 2021 | Estate Taxes, Family Businesses, Family Enterprise USA, In The News, Income Taxes, Step-Up In Basis, Taxes

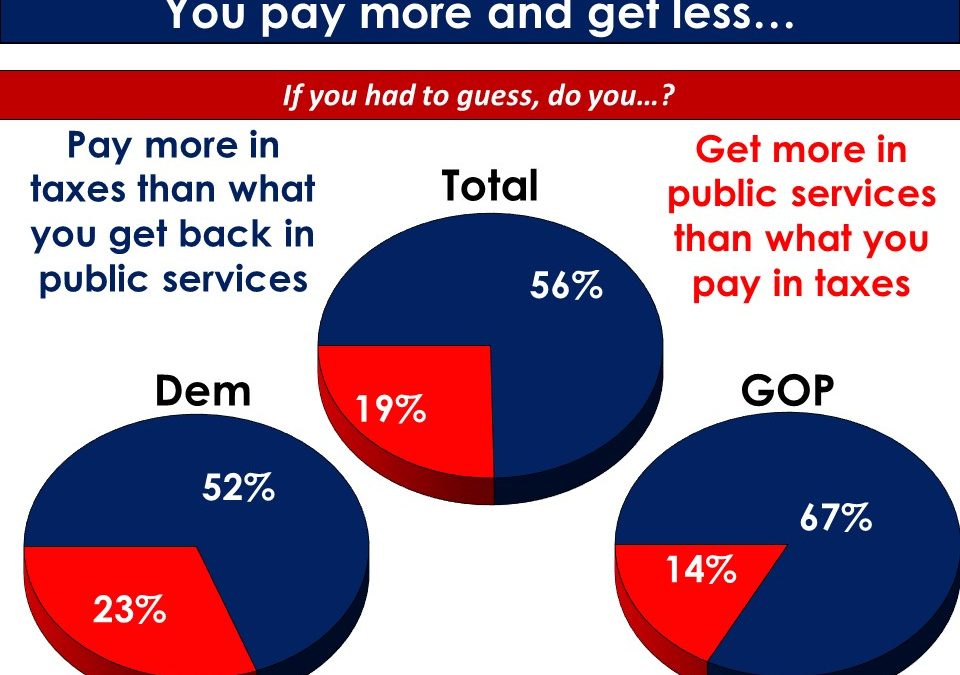

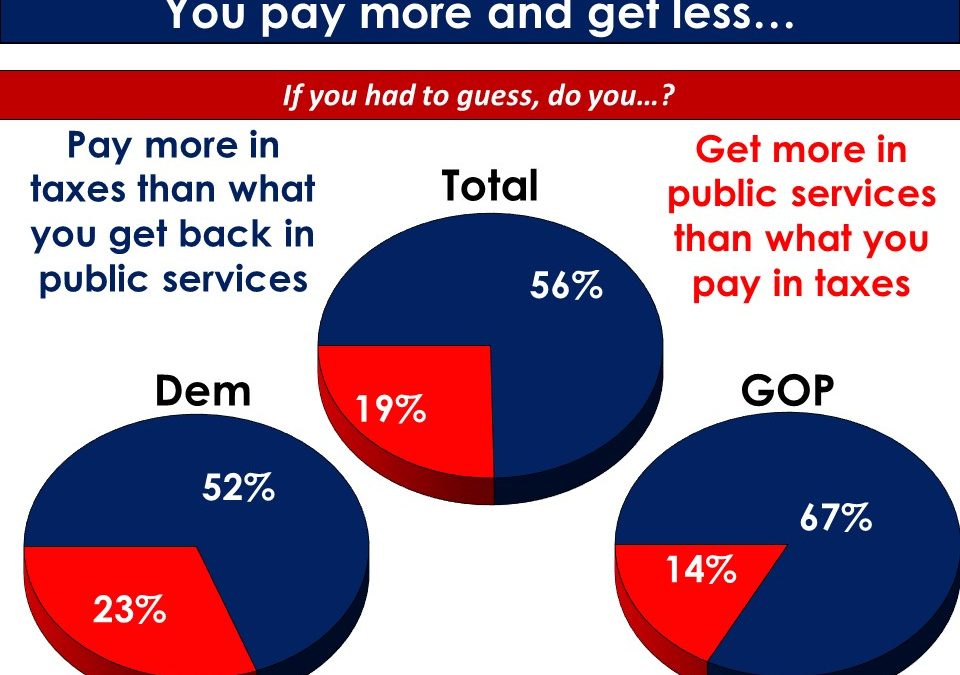

Contact Congress Now - It Only Takes a Minute With proposals emerging from the Biden White House that would raise the estate and capital gains taxes on America’s family-owned businesses, we were commissioned to ask the American people where they stood. We...

Aug 17, 2021 | Family Businesses, Family Enterprise USA, In The News

Thank you to BNY Mellon Wealth Management for this report. It’s critical to create a framework for joint decision-making in order to effectively pass control of the family business to future generations of stakeholders. Most family businesses take on the...

Aug 17, 2021 | Family Businesses, Family Enterprise USA, In The News

Thank you to BNY Mellon Wealth Management for this report. It’s critical that business owners leaving a large estate behind work with their Wealth Strategists to devise a plan that anticipates every eventuality and utilizes all the tools available to them. In...

Aug 15, 2021 | Family Enterprise USA, In The News, Taxes

President Biden has proposed two plans which would change tax policy, The American Jobs Plan and the American Families Plan. Included in these plans are some of the policies described below; please give us your opinion of what is most important to you, see the list...