Sep 1, 2018 | Estate Taxes

Wednesday, September 26, 2018 6:00pm Supporters and Members Dinner Acqua Al 2 212 7th Street SE Washington DC Thursday, September 27, 2018 10:00am-2:00pm Supporters and Members Meeting 20 F Street NW Conference Center; Washington, DC Speakers Frank Luntz Congressman...

Aug 23, 2018 | Estate Taxes

Chairman Brady intends to have the House address the 2018 Tax Bill 2.0 when they return from August recess; note that it will include making the estate tax life exemption doubling permanent. Click here for a brief recap of the legislation. Many meetings last week in...

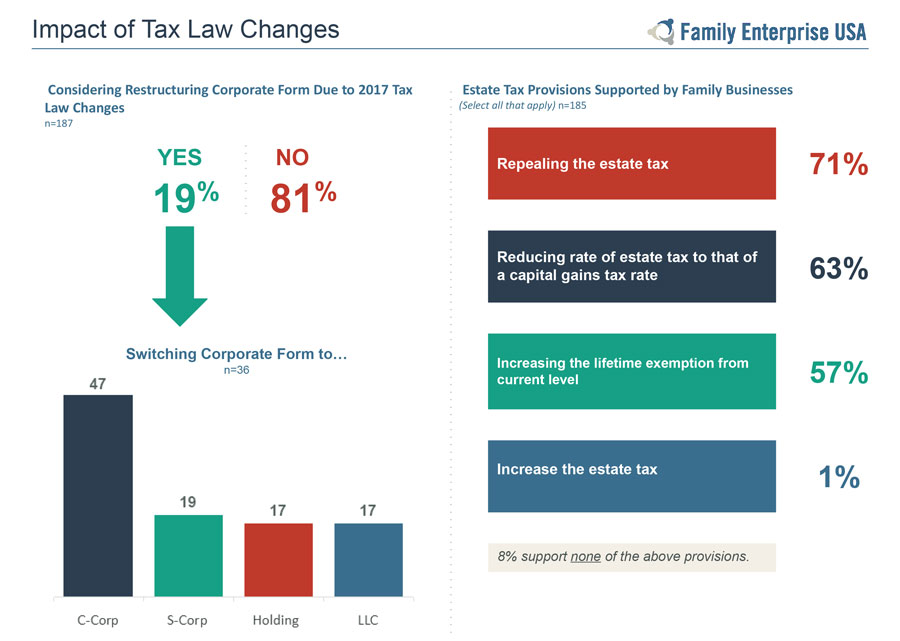

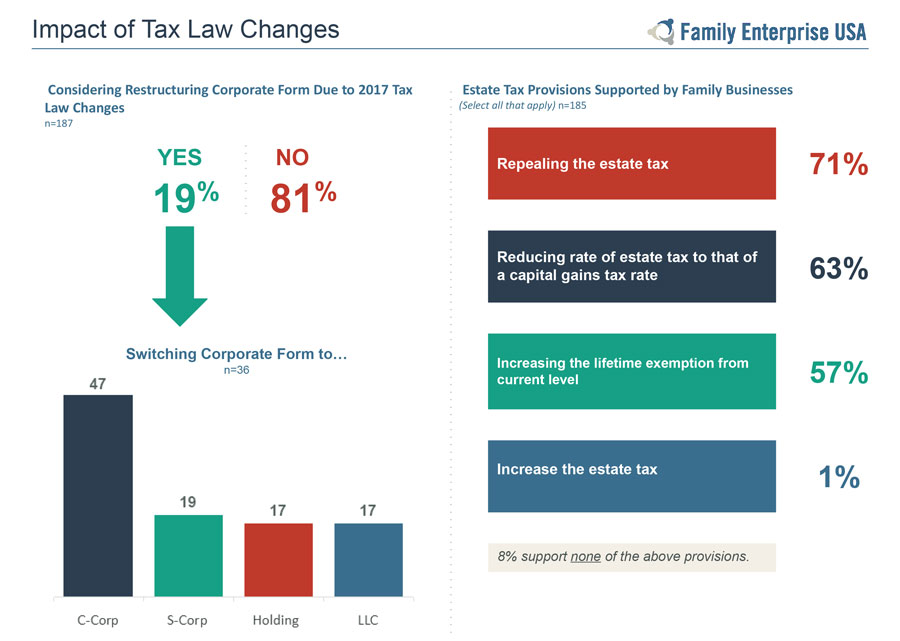

Jul 24, 2018 | Estate Taxes, Family Business Survey

New Survey of Family Businesses Reveals Commitments, Challenges, & Concerns Ahead Family business are key drivers of economic development, but taxes and regulations hinder growth Two-thirds of participating business owners employed more than 50 employees in 2017;...

Jul 24, 2018 | Family Business Survey, Family Businesses, Family Enterprise USA

View and Download The 2018 FEUSA Family Business Survey View and Download The 2018 FEUSA Family Business Survey

Jul 23, 2018 | Estate Taxes

Congressman Devin Nunes (CA-22) has introduced a bill in the House of Representatives to eliminate capital gains taxes on inflation. By ending this unfair tax, the Capital Gains Inflation Relief Act (H.R 6444) will encourage both individual and business investment...

Jul 17, 2018 | Estate Taxes

Policy and Taxation Group Supporters Meeting When Thursday, September 27, 2018 from 10:00 AM to 2:00 PM EDT Where Washington D.C. TBD Would you like updates on our estate tax activities, discuss the status of estate tax repeal, the politics of repeal, and estate tax...

Jul 5, 2018 | Estate Taxes

My personal view, for what is might be worth, is that lowering the corporate tax rate from the current 35% to 20% is too big a cut and unnecessary to serve the purpose intended. Certainly, a cut is needed, but just as certainly a reduction to 25% would provide the...

Jul 4, 2018 | Estate Taxes

June 13, 2018 My father started an aerospace component manufacturing business March 31, 1961 in Maywood, California. He started it by himself investing $7,500 dollars in the business. He hired one person. He struggled for 10 years before he finally made a profit. His...

Jul 3, 2018 | Estate Taxes

A family operating 100 hardware stores in the Midwest had to sell the business to a private equity firm in the 3rd generation of the family businesses. The family had already endured 2 generations of paying the estate tax and realized they could not survive another....

Jul 3, 2018 | Estate Taxes

As a family owned business for 97 years now, White Castle has learned a lot about what it takes to create an enterprise that’s sustainable and capable of nourishing our team members, and the communities where we live, work and raise our families. Along the way, not...