Policy Is Moving. Add Your Voice Now.

House, Senate Leave Capitol Hill as ‘One, Big, Beautiful’ Tax Bill Edges Closer to Reality for Family-Owned Businesses

Also, New Annual Survey Ranks Personal Income Taxes as Number One Concern

As Congress closed shop and left Washington, D.C. for their two-week spring break, House Republicans in a surprisingly rapid move approved a budget blueprint for tax and border priorities by agreeing to the Senate’s plan, and the price tag.

It’s a major win for Republican’s looking to wrap up all key tax initiatives into “one, big, beautiful, bill,” as it is being called, and if finalized could be a major win for family-owned businesses.

There are still many hurdles ahead before a White House signature makes it official. One big hurdle is finding the revenue or budget offsets, or cuts, of at least $1.5 trillion in federal spending to help lower the ten-year $4.5 trillion deficit price tag of the new bill.

Getting to this point was a roller coaster ride. Plans were nearly scrapped hours before it was approved, as some 20 Republicans wanted even steeper spending cuts to make way for tax cuts. At the last minute, Republican leaders convinced recalcitrant members to agree, for now, and fight the bigger fight later.

This is the first time a Republican-controlled Congress has passed a budget resolution since 2017, according to House Budget Committee Chairman Jodey Arrington (R-Texas), a former co-chair of the Congressional Family Business Caucus.

No doubt, conversations after the break will be tense as Republicans move the agreed upon budget resolution package toward using “Budget Reconciliation.” At the same time, Democrats will be fighting to keep government services intact, and the cost of the new tax plan neutral.

The reconciliation procedure allows an agreed upon final bill to be passed in the Senate with a simple majority of 51 votes, rather than the 60 votes usually required in exchange for limitations on what can be included in any bill. Because Republicans control the House, Senate, and White House, they can use reconciliation to pass a bill without bipartisan support or input.

Stay tuned. This ride is just getting started.

2025 Annual Family Business Survey Results

Each year, Family Enterprise USA conducts a survey on the state of family businesses in America. This year, the Family Enterprise USA Annual Family Business Survey was among the largest and most comprehensive surveys, with 730 respondents from 45 states.

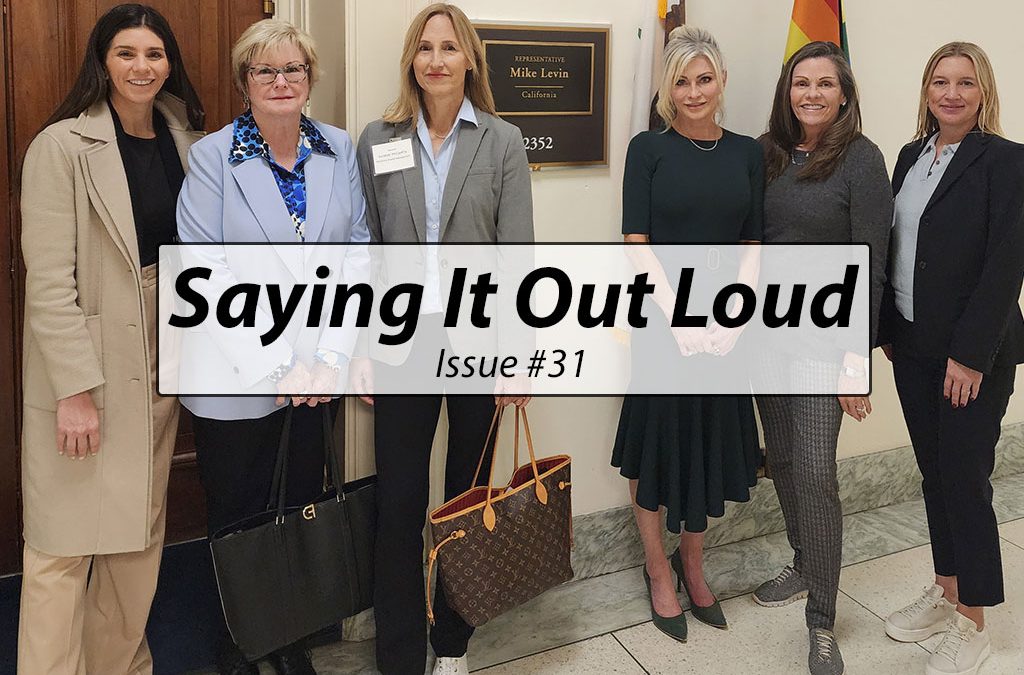

The survey results were highlighted at last month’s meeting of members of the Congressional Family Business Caucus on Capitol Hill, where 70 family-owned business leaders met with eight House members.

A few key takeaways from the 2025 survey found three tax policies “Of Top Concern” to family-owned businesses were (by percentage of respondents): 1) Income taxes (47%); 2) Estate taxes (“Death Tax”) (19%); and 3) Capital Gains taxes (12%).

The survey also found the top economic policy priorities for family-owned businesses right now are: “Reduce the Federal Budget/Debt” at 32%, and at number two, “Reduce Income Taxes,” at 21%.

When it came to Workforce Issues, the “Top 3” workforce challenges this year are: 1) Recruiting & Training (53%); 2) Benefits/Pay (26%); and 3) Culture Building (16%).

When asked about the “Greatest Impediment to Growth” this year and next, 29.3% of respondents said “Market Conditions” were the biggest barrier, while 25.4% said “Cost/Availability of Labor” was the greatest impediment to growth. It should be noted the survey was conducted in January and February of this year, before the current levying of global tariffs by the Trump Administration.

As for the Estate Tax, or Death Tax, the survey found 33.1% wanted to keep “Current Exemption Level,” a drop from the 36% who responded this way last year. Some 29.9% said they wanted to “Repeal the Estate Tax” completely, an increase from 26% in the 2024 survey.

This research is an important annual tool we use to help educate policy makers understand the importance and size of family-owned businesses in our economy, and hopefully they will make better policy decisions to America’s number one private employer grow and prosper.

We hope you've enjoyed this article. While you're here, we have a small favor to ask...

As we prepare for what promises to be a pivotal year for America, we're asking you to consider becoming a member.

The need for fact-based reporting of issues important to family owned businesses and protecting a lifetime of savings has never been greater. Now more than ever, successful families and family owned businesses are under fire. That's why Family Enterprise USA is passionately working to increase the awareness of issues important to family owned businesses built on hard work, while continuing to strengthen our presence on Capitol Hill. The issues we fight for or against with Congress in Washington DC include high income tax rates, possible elimination of valuation discounts, increase in capital gains tax, enactment of a wealth tax, and the continued burden of the gift tax, estate tax and generation skipping tax.

Family Enterprise USA promotes generationally owned family business creation, growth, viability, and sustainability by advocating for family businesses and their lifetime of savings with Congress in Washington DC. Since 2007, Family Enterprise USA has represented and celebrated all sizes, professions and industries of family-owned enterprises and multi-generational employers. It is a bi-partisan 501.c3 organization. Family foundations can donate.

#incometax #CapitalGainsTax #R&DExpensing #DontPunishSuccess #GrantorTrusts #StepUpinBasis #likeKindExchanges #AcceleratedDepreciation #EstateTax #Deathtax #wealthtax #taxLegislation #CongressionalCaucus #incometaxrates #repealestatetax #AdvocatingForFamilyBusinesses #FamilyOwnedBusiness #WomenOwnedBusiness @FamilyEnterpriseUSA #FamilyEnterpriseUSA #FEUSA