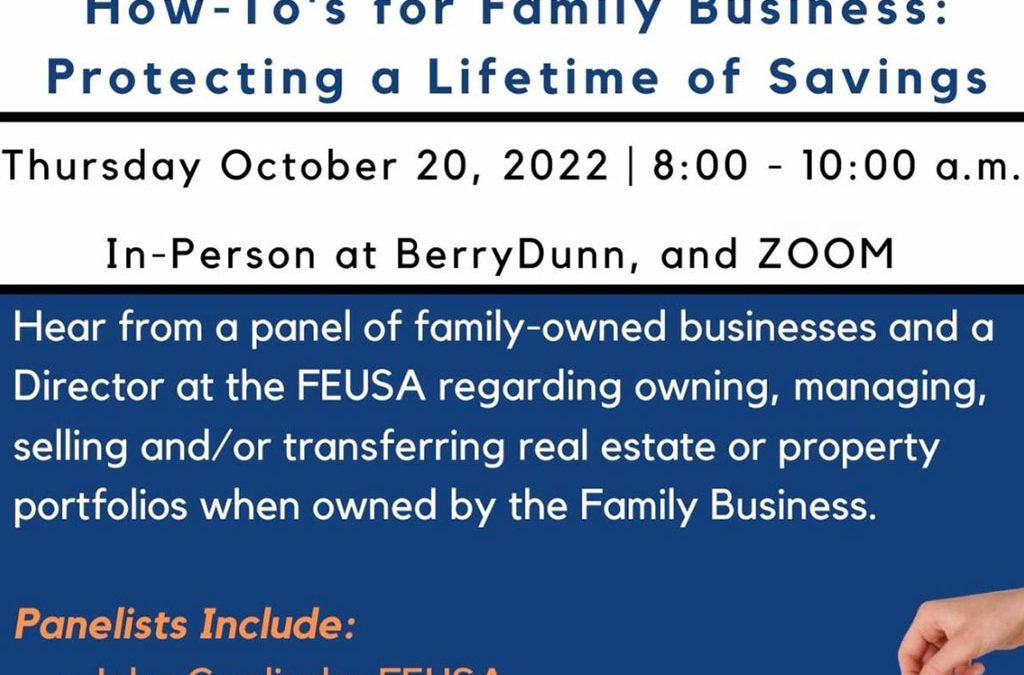

What Washington Needs to Know and Benefits of Businesses Owning Their Own Real Estate

Thursday, October 20, 2022 | 8:00 – 10:00 a.m.

Join John Gugliada, Family Enterprise USA’s (FEUSA) Director of Strategic Partnerships & Business Development, who will set the stage as he shares important insights collected from the organization’s annual Family Business survey and meetings with members of Congress including their top tax concerns, succession data, and significant family business challenges. Family businesses will learn how important they are to the economy and how to advise Congress of their importance, along with proposals that will change their businesses.

From this theme of protecting a lifetime of savings, we’ll then discuss breaking down the “bricks & mortar” of owning, managing, selling and/or transferring real estate and property portfolios when owned by the family business. We’ll hear from Spinnaker Trust and their commercial real estate investment group, the Boulos Company, a local commercial real estate brokerage and family-owned business, Renys who owns multiple retail locations throughout the state, and Hardypond Construction, a local family-owned construction company.

We hope you've enjoyed this article. While you're here, we have a small favor to ask...

As we prepare for what promises to be a pivotal year for America, we're asking you to consider becoming a member.

The need for fact-based reporting of issues important to family owned businesses and protecting a lifetime of savings has never been greater. Now more than ever, successful families and family owned businesses are under fire. That's why Family Enterprise USA is passionately working to increase the awareness of issues important to family owned businesses built on hard work, while continuing to strengthen our presence on Capitol Hill. The issues we fight for or against with Congress in Washington DC include high income tax rates, possible elimination of valuation discounts, increase in capital gains tax, enactment of a wealth tax, and the continued burden of the gift tax, estate tax and generation skipping tax.

Family Enterprise USA promotes generationally owned family business creation, growth, viability, and sustainability by advocating for family businesses and their lifetime of savings with Congress in Washington DC. Since 2007, Family Enterprise USA has represented and celebrated all sizes, professions and industries of family-owned enterprises and multi-generational employers. It is a bi-partisan 501.c3 organization. Family foundations can donate.

@FamilyEnterpriseUSA @PolicyAndTaxationGroup @DitchTheEstateTax #FamilyBusiness #Business #SmallBiz #EstateTax #Deathtax #CapitalGainsTax #StepUpInBasis #Taxes #gifttax #Generationskippingtax #InheritanceTax #repealestatetax #promotefamilybusinesses #taxLegislation #AdvocatingForFamilyBusinesses #incometax #Generationallyowned #Multigenerationalbusiness #taxes #taxseason #federaltaxpolicy #FamilyEnterpriseUSA #PolicyAndTaxationGroup #DitchTheEstateTax