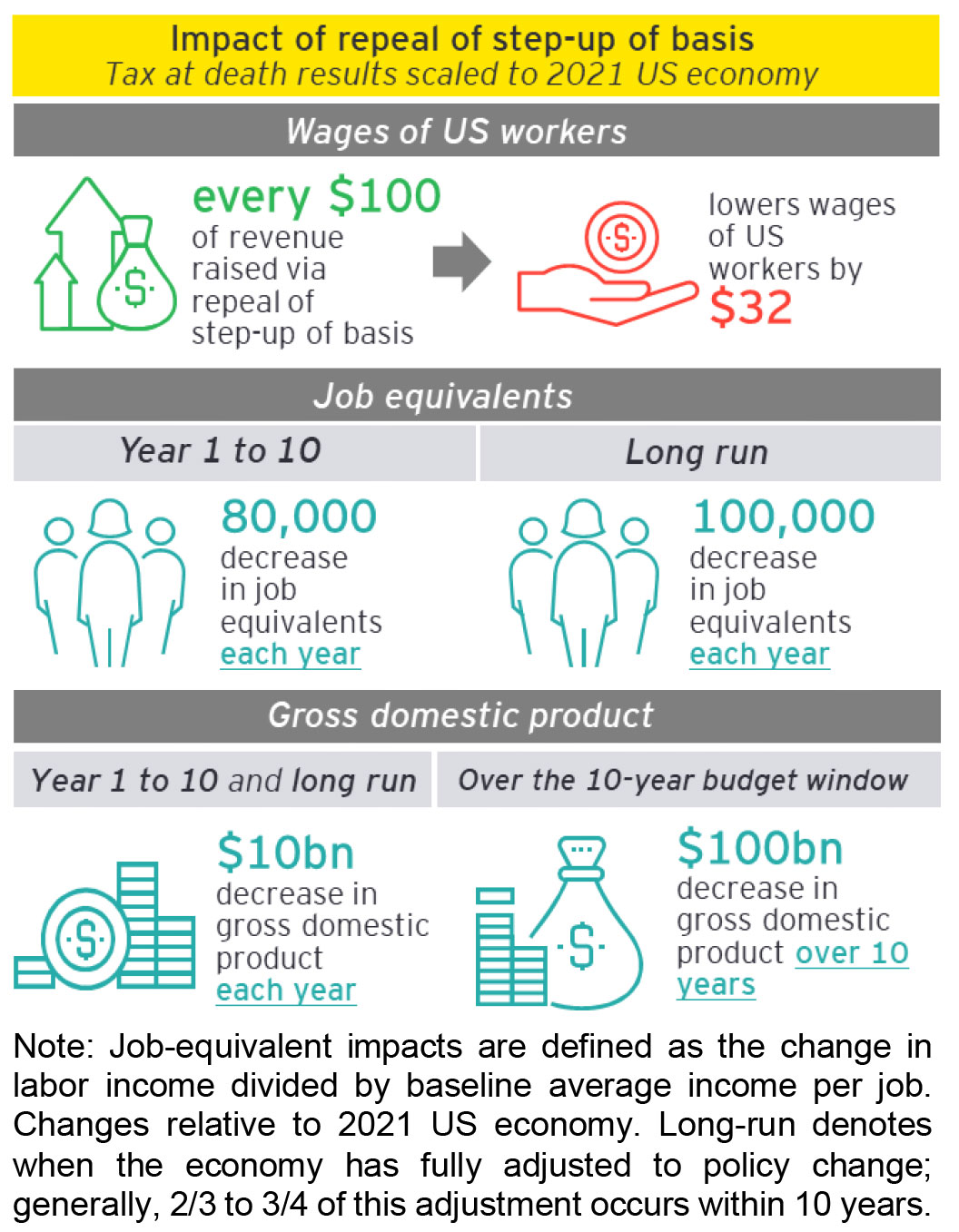

President Biden has proposed the elimination of the “step up in basis,” while keeping the 40% (or higher) estate tax on the full value of a family business owner’s assets.

That means that each person who inherits a business will pay taxes on the same appreciation over and over again, each time the business changes hands. And he wants to raise the capital gains tax rate to 39.6 %. (Basically the same as the estate rate).

Family Enterprise USA advocates for American Family business. We help family businesses communicate their challenges and contributions to American economic freedom to Legislators. We represent all American family businesses; not just specific industries and provide research to enhance the opportunity for success. We help family businesses continue to establish their unique business legacy. Family Enterprise USA is a 501(c)(3) non-profit organization.. Family foundations can donate.