Thank you to BNY Mellon Wealth Management for this report.

One way donors can meet their philanthropic goals, while gaining some tax benefits, is through the gift of a business to a public charity.

Every wealth planning discussion should include a conversation about philanthropy. Whether giving during one’s lifetime or legacy giving through one’s estate, identifying philanthropic goals and establishing a financial plan to support those goals can result in both charitable and financial planning benefits. Charitable giving can be as simple as writing a check or as complex as establishing a foundation with many other techniques along the spectrum that provide various income and estate tax benefits. One way donors can meet their philanthropic goals, while gaining some tax benefits, is through the gift of a business to a public charity.

BENEFITS OF GIVING A BUSINESS INTEREST TO CHARITY

A donor who gives a business interest to charity will be entitled to an individual income tax charitable deduction equal to the fair market value of the interest, subject to some important exceptions noted in Exhibit 1. For business owners who are considering selling their business, making a gift of a business interest to charity could result in significant tax savings.

By making a charitable gift of a business interest, the donor will avoid the income tax, and, if applicable, the 3.8% surtax on net investment income, on the portion of the interest given to charity. However, depending on the type of business interest, the charitable recipient may be taxable on the business’ unrelated business taxable income from the ongoing business activities, as well as upon the charity’s disposition of the business interest.

The income tax consequences of the gift of a business interest depends on the type of business interest being given to charity. Some businesses will result in unrelated business taxable income, which will result in such income becoming taxable to the charity.

Exhibit 1: Limitations on the Amount of the Income Tax Charitable Deduction

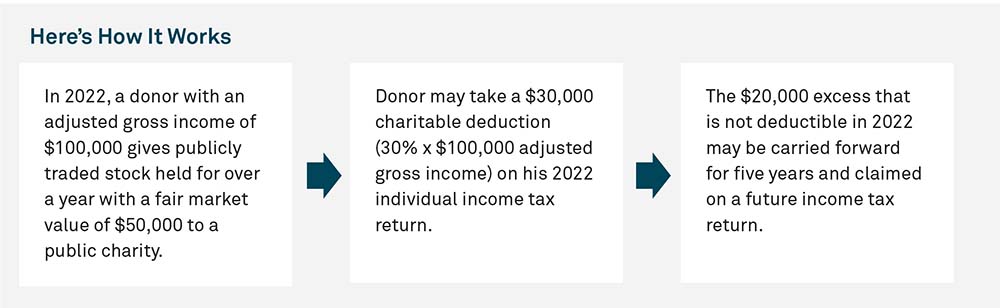

- The annual income tax charitable deduction for gifts of long-term (held over a year) capital gain property to a public charity is limited to 30% of the donor adjusted gross income

- The deduction is equal to the fair market value of the property except for ordinary income property, in which case the deduction is limited to the property’s cost basis.

- The donor can elect to have a 50% of adjusted gross income apply if the value of the gift is limited to the donor’s cost basis in the property

- Any contribution that exceeds the percentage

WHAT ARE THE TYPES OF BUSINESS INTERESTS A DONOR MAY GIVE TO CHARITY?

Business interests fall into one of three categories: (1) C corporations, (2) S corporations and (3) partnerships (including interest in a limited liability company (LLC)).

C Corporations

C corporation income is subject to double taxation – once at the corporate level when the income is earned and again at the shareholder level when the corporation’s income is distributed to its shareholders in the form of dividends.

The gift of C corporation stock to a public charity is a fairly straightforward transaction.

The gift of C corporation stock held for over a year to a public charity will entitle the donor to an income tax charitable deduction equal to the fair market value of the stock. The charitable deduction is limited to 30% of the donor’s adjusted gross income.

Distributions from the C corporation to the charity are exempt from the UBTI tax under the dividend exception to the definition of UBTI. Any gain realized on the sale of the C corporation stock is capital gain and is also excepted from the definition of UBTI. See Exhibit 2.

Thus, UBTI is not an issue for a charity that receives a gift stock in a C corporation

Exhibit 2: What Is Unrelated Business Taxable Income (UBTI)?

UBTI is defined as net income received by an exempt organization from (1) a trade or business, (2) regularly carried on, (3) which is substantially unrelated to the organization’s exempt purpose. UBTI may also be generated by debt financed income.

Items that are exempt from the definition of UBTI include dividends, interest, annuities, royalties, rental income from real property (subject to some exceptions) and capital gain on the sale of appreciated assets. These exceptions are important for the gifts of some types of business interest as discussed below.

UBTI is taxable to the charity subject to a $1,000 exemption.

S Corporations

The income of an S corporation is taxed only once at the shareholder level. All income, deductions and credits flow through from the entity to the shareholders.

A gift of S corporation stock presents a bigger challenge for both the donor and the charity.

The gift of S corporation stock held for over a year to a public charity will generally result in the donor receiving an income tax charitable deduction equal to the fair market value of the stock limited to 30% of the donor’s adjusted gross income. However, the deduction must be reduced by any recapture or ordinary income attributable to the S corporation stock.

All of the income that flows through from the S corporation to the charity is treated as UBTI and taxed to the charity, even though the character of the income might otherwise be excepted from the definition of UBTI, such as interest, dividends and rent. The same is true for gain on a sale. Thus, all the S corporation income reportable by the charity, including gain on the sale of the S corporation stock by the charity, is taxable to the charity as UBTI.

Other issues complicate the gift of S corporation stock to a public charity. Generally, a charity is an eligible S corporation shareholder. However, a charitable remainder trust cannot be an S corporation shareholder. If S corporation stock falls into the hands of an ineligible shareholder, the corporation loses its status as an S corporation and becomes a C corporation, the income of which is subject to double taxation.

Also, the S corporation stock, being illiquid, requires a valuation, which could be expensive.

Partnerships and LLCs

Partnership income is taxed only once, at the shareholder level. Like an S corporation, all the income, deductions and credits flow through and are taxed at the partner level.

A donor will generally receive an income tax charitable deduction for the gift of a partnership interest held for over a year to a public charity equal to the fair market value of the gift of the partnership interest less any ordinary income and the donor’s share of liabilities.

Income from UBTI exempt sources, such as interest, dividends, capital gains, etc., retain the same character as if such income were realized directly from the source from which it was realized by the partnership. In other words, the charity’s share of these sources of income is exempt from UBTI.

A transfer of a partnership interest subject to debt is subject to the bargain sale rules. That means that the donor is deemed to have received consideration in an amount equal to the amount of the debt. Thus, gain must be recognized by the donor even though no cash has been received. Under the bargain sale rules, the cost basis of the partnership interest must be allocated between the charitable gift portion and the sale portion.

Gift of partnership interests also raise a number of practical problems such as the following:

- Is charity an acceptable partner?

- Is the partnership a suitable investment for the charity?

- The possibility of a capital call by the partnership

- Indemnification clauses

- Partnership transfer restrictions

- Lack of control of a minority interest owned by the charity

- Illiquidity of the partnership interest

- Difficult valuation of the partnership interest

- Unlimited liability for the gift of a general partnership interest

THE PROBLEM OF A PENDING SALE, MERGER, INITIAL PUBLIC OFFERING

Frequently, donors will attempt to gift a business interest immediately prior to a liquidity event, hoping to secure an individual income tax charitable deduction, but more importantly, avoid income tax on the appreciation of the business interest. The issue that arises is whether the donor will be treated by the Internal Revenue Service as having sold the stock, recognized the gain and contributed the proceeds rather than having donated the stock and avoided tax on the gain. The answer is dependent upon the individual facts and circumstances of each case. As a result, donors should be encouraged to make the gift well in advance of any liquidity event to avoid the Internal Revenue Service from re-characterizing the gift.

SUBSTANTIATION REQUIREMENTS

Charitable gifts of property require complex and detailed substantiation requirements. Failure to strictly comply with the substantiation requirements will result in the loss of the income tax charitable deduction.

A charitable gift of property worth more than $5,000 must be substantiated by a qualified appraisal by a qualified appraiser. Each of the terms “qualified appraisal” and “qualified appraiser” are themselves subject to complex requirements. Not any appraisal or appraiser will do. For example, one requirement is that the appraisal must be completed no later than 60 days before the date of the gift. The appraisal requirement does not apply to cash, publicly traded securities, or non-publicly traded stock worth $10,000 or less.

The donor must also report the charitable gift on a Form 8283 (“Noncash Charitable Contributions”) if the total charitable deduction claimed for the noncash property exceeds $500. C corporations (other than personal service corporations and closely held corporations) must file Form 8283 only if the deduction claimed exceeds $5,000.

The charity, on the other hand, must report a disposition of the gifted property made within 3 years of the gift to the Internal Revenue Service on Form 8282 (“Donee Information Return”). This reporting requirement does not apply to publicly traded stock or to dispositions of property worth $500 or less.

NEXT STEPS

The charitable gifts of a business interest involve the complex interaction of a variety of different rules. A careful analysis of the type of interest being donated and the tax rules associated with that interest need to be carefully reviewed. In addition, there are a number of practical considerations that need to be understood by both the donor and the charity. Not all of the potential issues are discussed above. We encourage you to seek professional advice to help make the decisions that are best for you.

About BNY Mellon Wealth Management

For more than two centuries, BNY Mellon Wealth Management has helped families build, manage and preserve their wealth. Our specialized teams have the tools, knowledge and experience to develop comprehensive solutions for our business owner clients that address each client’s personal financial objectives and family dynamics, as well as issues specific to his or her business. For business owners considering a family office, our dedicated Family Office team brings more than 50 years of experience providing solutions and strategic insights to help family offices grow and preserve wealth across generations. For more information, visit www.bnymellonwealth.com or follow us on Twitter @BNYMellonWealth.

Family Enterprise USA advocates for American Family business. We help family businesses communicate their challenges and contributions to American economic freedom to Legislators. We represent all American family businesses; not just specific industries and provide research to enhance the opportunity for success. We help family businesses continue to establish their unique business legacy. Family Enterprise USA is a 501(c)(3) non-profit organization.. Family foundations can donate.

We hope you’ve enjoyed this article. While you’re here, we have a small favor to ask…

As we prepare for what promises to be a pivotal year for America, we’re asking you to consider becoming a member.

The need for fact-based reporting of issues important to multi generational businesses and protecting a lifetime of savings has never been greater. Now more than ever, multi generational businesses and family businesses are under fire. That’s why FEUSA is passionately working to increase the awareness of issues important to generationally-owned family businesses built on hard work, while continuing to strengthen our presence on Capitol Hill.

@FamilyEnterpriseUSA @PolicyAndTaxationGroup @DitchTheEstateTax #FamilyBusiness #Business #SmallBiz #EstateTax #Deathtax #CapitalGainsTax #StepUpInBasis #Taxes #gifttax #Generationskippingtax #InheritanceTax #repealestatetax #promotefamilybusinesses #taxLegislation #AdvocatingForFamilyBusinesses #incometax #Generationallyowned #Multigenerationalbusiness