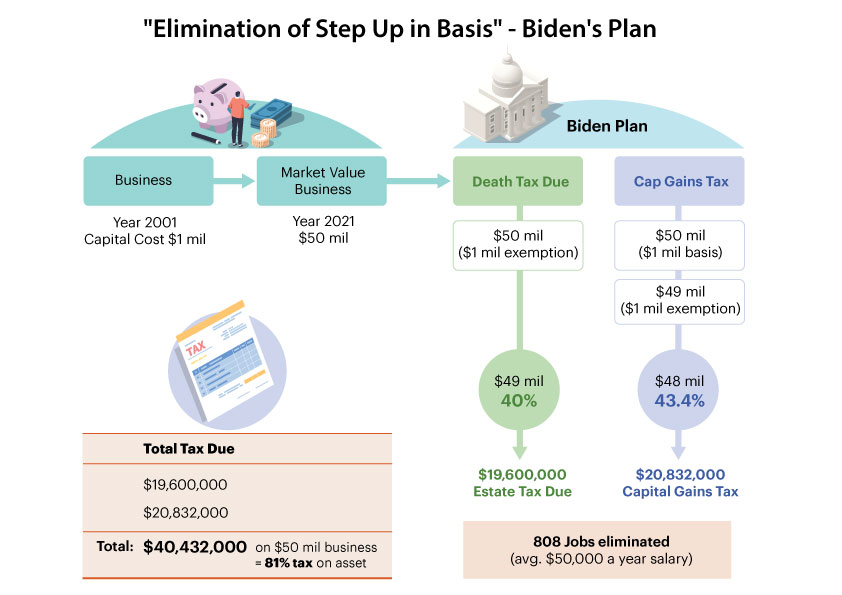

While the devil is in the details, it is possible that if President Biden’s elimination of step-up in basis proposal is passed by Congress you could be paying an estate tax at 40%, and a capital gains tax at 43.4%.

The graphic below shows an example of a business worth $50 million, and at the founder’s death, an 81% tax COULD be paid.

So pay close attention to what is being discussed and let your members of Congress know you do not support elimination of step up in basis.

Family Enterprise USA advocates for American Family business. We help family businesses communicate their challenges and contributions to American economic freedom to Legislators. We represent all American family businesses; not just specific industries and provide research to enhance the opportunity for success. We help family businesses continue to establish their unique business legacy. Family Enterprise USA is a 501(c)(3) non-profit organization.. Family foundations can donate.