Make 2026 the year your voice moves policy. Discover powerful but simple advocacy tips for family business leaders.

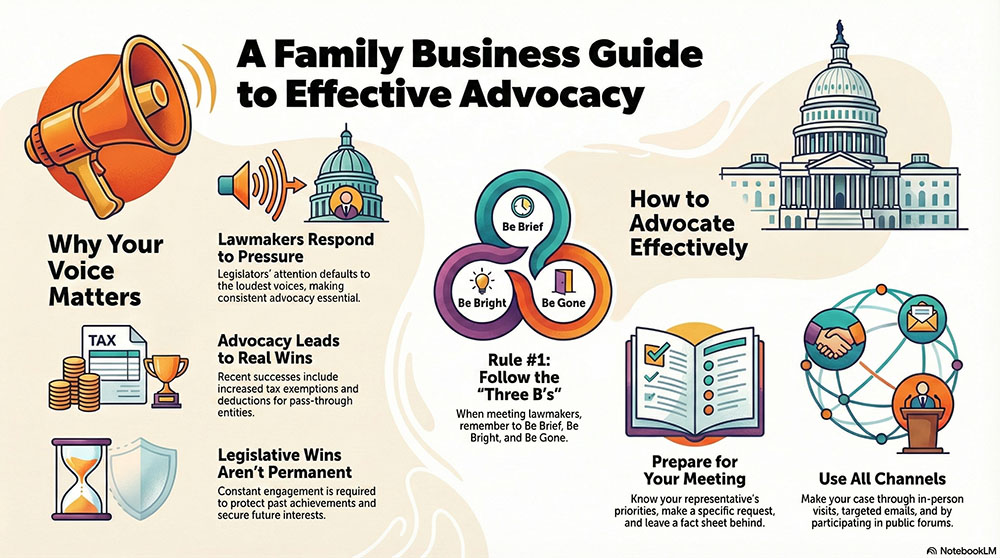

What if influencing policy wasn’t intimidating—just strategic? In “The Art of Influence: Getting Your Voice Heard on Capitol Hill,” published in Family Business Magazine, family business advocacy expert Pat Soldano breaks down how owners and leaders can effectively make their voices matter in Washington.

From real wins already secured for family firms to practical step-by-step tactics you can use this year, the article turns a daunting task into doable actions.

You’ll learn how to:

- Identify and understand your elected representatives before you reach out.

- Prepare for in-person visits with a sharp message that takes two minutes or less.

- se the “Three B’s Rule” — be brief, be bright, be gone! — to grab attention.

- raft persuasive emails and leave-behind fact sheets that reinforce your case.

Advocacy isn’t just for professional lobbyists — it’s one of the most effective ways your family business can protect its priorities and shape public policy.

Read the full article to unlock proven strategies that will make 2026 the year your voice gets heard. Click Here.

We hope you've enjoyed this article. While you're here, we have a small favor to ask...

As we prepare for what promises to be a pivotal year for America, we're asking you to consider becoming a member.

The need for fact-based reporting of issues important to family owned businesses and protecting a lifetime of savings has never been greater. Now more than ever, successful families and family owned businesses are under fire. That's why Family Enterprise USA is passionately working to increase the awareness of issues important to family owned businesses built on hard work, while continuing to strengthen our presence on Capitol Hill. The issues we fight for or against with Congress in Washington DC include high income tax rates, possible elimination of valuation discounts, increase in capital gains tax, enactment of a wealth tax, and the continued burden of the gift tax, estate tax and generation skipping tax.

Family Enterprise USA promotes generationally owned family business creation, growth, viability, and sustainability by advocating for family businesses and their lifetime of savings with Congress in Washington DC. Since 2007, Family Enterprise USA has represented and celebrated all sizes, professions and industries of family-owned enterprises and multi-generational employers. It is a bi-partisan 501.c3 organization. Family foundations can donate.

#incometax #CapitalGainsTax #R&DExpensing #DontPunishSuccess #GrantorTrusts #StepUpinBasis #likeKindExchanges #AcceleratedDepreciation #EstateTax #Deathtax #wealthtax #taxLegislation #CongressionalCaucus #incometaxrates #repealestatetax #AdvocatingForFamilyBusinesses #FamilyOwnedBusiness #WomenOwnedBusiness @FamilyEnterpriseUSA #FamilyEnterpriseUSA #FEUSA