Policy Is Moving. Add Your Voice Now.

New ‘Protecting Wealth in Today’s Legislative Environment’ Events: North Carolina & Arkansas

Family Enterprise USA Events Held at Wake Forest Center for Private Business and University of Arkansas Jim Walcott Family Enterprise Center

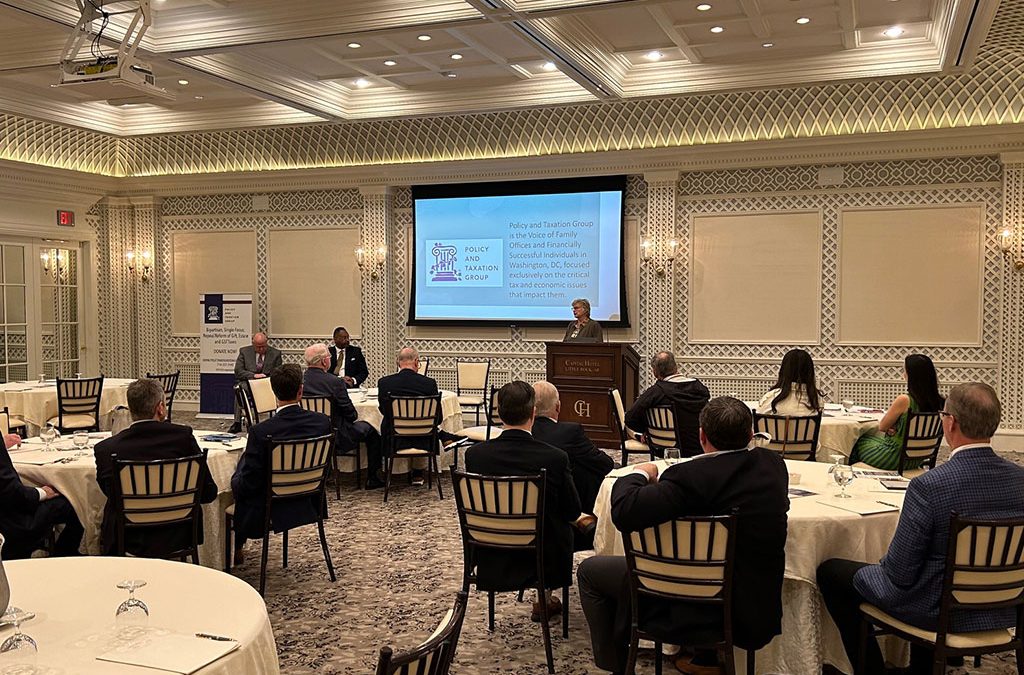

Event Focus: “Protecting the Wealth of Family Businesses and Family Offices in Today’s Legislative Environment,” with Capitol Hill Experts Russ Sullivan, Aubrey Rothrock

Sign-up for the August 27, CEO Luncheon at Wake Forest University’s Center for Private Business, featuring Capitol Hill insiders from the Family Enterprise USA team. The event, from 11:30AM to 1PM, features presenters Russ Sullivan, Practice Chair, National Tax Policy Group, Brownstein, Washington, D.C., and Aubrey Rothrock, Partner, Legislative and Regulatory Affairs, Squire Patton Boggs, Washington, D.C., as well as Family Enterprise USA host John Gugliada. Director of Family Business Engagement. The discussion centers on protecting family business wealth while navigating today’s complex legislative environment.

The Wake Forest University Center for Private Business is a membership organization that supports and serves privately held and family-owned businesses across North Carolina.

For more information contact: John Gugliada at: jgugliada@family-enterpriseusa.com

Event in Fort Smith, Arkansas, September 11

The University of Arkansas Fort Smith Jim Walcott Family Enterprise Center will hold a breakfast presentation from 8AM – 9:30AM featuring presenters Russ Sullivan, Practice Chair, National Tax Policy Group, Brownstein Washington, D.C., and Family Enterprise USA host John Gugliada, Director of Family Business Engagement. This discussion will also focus on protecting family business wealth while navigating today’s complex legislative environment.

The Jim Walcott Family Enterprise Center offers family businesses a learning community to meet the unique needs of the family in business.

For more information contact: John Gugliada at: jgugliada@family-enterpriseusa.com

We hope you've enjoyed this article. While you're here, we have a small favor to ask...

As we prepare for what promises to be a pivotal year for America, we're asking you to consider becoming a member.

The need for fact-based reporting of issues important to family owned businesses and protecting a lifetime of savings has never been greater. Now more than ever, successful families and family owned businesses are under fire. That's why Family Enterprise USA is passionately working to increase the awareness of issues important to family owned businesses built on hard work, while continuing to strengthen our presence on Capitol Hill. The issues we fight for or against with Congress in Washington DC include high income tax rates, possible elimination of valuation discounts, increase in capital gains tax, enactment of a wealth tax, and the continued burden of the gift tax, estate tax and generation skipping tax.

Family Enterprise USA promotes generationally owned family business creation, growth, viability, and sustainability by advocating for family businesses and their lifetime of savings with Congress in Washington DC. Since 2007, Family Enterprise USA has represented and celebrated all sizes, professions and industries of family-owned enterprises and multi-generational employers. It is a bi-partisan 501.c3 organization. Family foundations can donate.

#incometax #CapitalGainsTax #R&DExpensing #DontPunishSuccess #GrantorTrusts #StepUpinBasis #likeKindExchanges #AcceleratedDepreciation #EstateTax #Deathtax #wealthtax #taxLegislation #CongressionalCaucus #incometaxrates #repealestatetax #AdvocatingForFamilyBusinesses #FamilyOwnedBusiness #WomenOwnedBusiness @FamilyEnterpriseUSA #FamilyEnterpriseUSA #FEUSA