The data is in! See what family owned businesses are saying about today’s challenges and opportunities.

On Monday, March 11, President Joe Biden released his Budget request to Congress (“Budget”) and various accompanying documents. Separately, the Treasury Department released its General Explanations of the Administration’s Fiscal Year 2025 Revenue Proposals, commonly known as the “Green Book,” which provides more detailed descriptions of the tax proposals in the Budget along with associated revenue estimates.

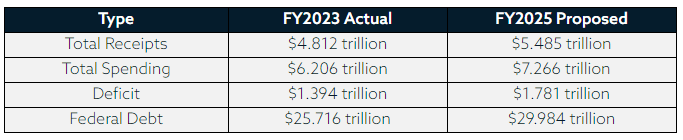

The $7.3 trillion Budget is the largest in U.S. history, including $1.6 trillion in base discretionary spending—approximately $895 billion for defense and $734 billion in non-defense discretionary spending. If enacted in its entirety, the Budget would raise $5 trillion in additional tax revenue over the next 10 years compared to baseline budgetary estimates. For FY2025, the Budget would result in an estimated federal deficit of approximately $1.8 trillion—an increase of about 30% compared to FY2023 levels. Below are key figures in the president’s Budget.

Treasury Secretary Janet Yellen will appear before the Senate Finance Committee on Thursday, March 21, to address lawmakers’ questions. Yellen is expected to also participate in a similar hearing with the House Ways and Means Committee following the spring recess.

This is the fourth and final Budget proposal that Biden will submit to Congress before the end of his first term, highlighting the tax-policy priorities that will continue to be central to his reelection campaign. Republicans are expected to oppose a majority of the tax and spending proposed in the Biden Budget request, and the extent of congressional Democrats’ support for all of the tax proposals is uncertain.

Below are the Brownstein tax policy team’s five key takeaways on the Budget:

- Proposed $5 Trillion Tax Increase Produces Net Projected Deficit Reduction of $3 Trillion.

- Absent Recommendations to Address TCJA Expirations, the Biden Budget Leaves Democrats’ Opening Position Unclear in the Lead-Up to 2025 Tax Reform.

- Political Priorities Take Center Stage as Biden Ramps Up Campaign Effort.

- Biden Doubles Down on Long-Term IRS Expansion, Requesting Over $100 Billion in Additional Mandatory Funding and Expanded Enforcement Authority.

- Yellen Refuses to Alter Course on the Global Tax Agreement and Other International Tax Reforms.

To read more about these takeaways and next steps, please click below.

About Brownstein Hyatt Farber Schreck

Brownstein Hyatt Farber Schreck is a unique law firm. Walk into any of our offices and you’ll immediately recognize a different type of energy. Complacency doesn’t have a place here. Flexibility and inspiration do. Our culture and enthusiasm allow our attorneys, policy consultants and legal staff to stay ahead of our clients’ needs and provide them with the resources they require to meet their business objectives.

We hope you've enjoyed this article. While you're here, we have a small favor to ask...

As we prepare for what promises to be a pivotal year for America, we're asking you to consider becoming a member.

The need for fact-based reporting of issues important to family owned businesses and protecting a lifetime of savings has never been greater. Now more than ever, successful families and family owned businesses are under fire. That's why Family Enterprise USA is passionately working to increase the awareness of issues important to family owned businesses built on hard work, while continuing to strengthen our presence on Capitol Hill. The issues we fight for or against with Congress in Washington DC include high income tax rates, possible elimination of valuation discounts, increase in capital gains tax, enactment of a wealth tax, and the continued burden of the gift tax, estate tax and generation skipping tax.

Family Enterprise USA promotes generationally owned family business creation, growth, viability, and sustainability by advocating for family businesses and their lifetime of savings with Congress in Washington DC. Since 2007, Family Enterprise USA has represented and celebrated all sizes, professions and industries of family-owned enterprises and multi-generational employers. It is a bi-partisan 501.c3 organization. Family foundations can donate.

#incometax #CapitalGainsTax #R&DExpensing #DontPunishSuccess #GrantorTrusts #StepUpinBasis #likeKindExchanges #AcceleratedDepreciation #EstateTax #Deathtax #wealthtax #taxLegislation #CongressionalCaucus #incometaxrates #repealestatetax #AdvocatingForFamilyBusinesses #FamilyOwnedBusiness #WomenOwnedBusiness @FamilyEnterpriseUSA #FamilyEnterpriseUSA