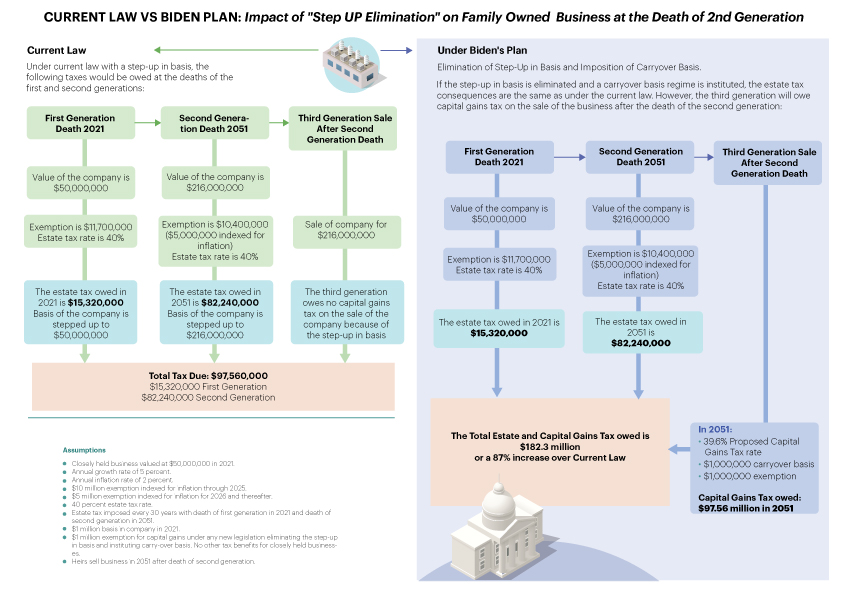

President Biden has proposed an elimination of step up in basis and an increase in the capital gains tax; how much will this impact family businesses?

See the example below.

A $50 million family business could be subject to a $82 million estate tax after the death of second generation, and an additional capital gains tax of $97 million for a total tax of $182 million when the business is sold by the 3rd generation to pay the estate tax!!!

Family Enterprise USA advocates for American Family business. We help family businesses communicate their challenges and contributions to American economic freedom to Legislators. We represent all American family businesses; not just specific industries and provide research to enhance the opportunity for success. We help family businesses continue to establish their unique business legacy. Family Enterprise USA is a 501(c)(3) non-profit organization.. Family foundations can donate.